As of January 2026, global markets face a severe systemic risk driven by Donald Trump’s proposal of 10% to 25% tariffs on NATO allies (Denmark, Germany, France, UK) to leverage the acquisition of Greenland. With indices at all-time highs and asset managers holding record net short positions in the VIX, the “Greenland Factor” serves as a primary detonator for a technical and fundamental correction, following gains exceeding 40% since April 2025.

I have been analyzing financial markets for decades, yet what we are witnessing in early 2026 defies conventional risk-reward logic. As I write this, the S&P 500 continues to hover near all-time highs, propelled by blind euphoria in the Artificial Intelligence sector and the perceived resilience of the American consumer. However, the “black swan” is not an unpredictable event; it has a name, a face, and a territorial obsession: Donald Trump and the NATO tariffs over Greenland. The keyword for any investor today is survival, as the rhetoric regarding the acquisition of the Danish territory has shifted from a social media meme to the cornerstone of a Trade War 2.0 that threatens to implode global supply chains and the stability of the transatlantic alliance itself.

Many of you ask me if this is merely “political noise.” My answer is blunt and firm: it is not. When the President of the United States uses Truth Social to announce that, effective February 1, 2026, he will apply a 10% tariff on all goods from Denmark, France, the UK, and other allies—scaling to 25% by June if a “total sale” of Greenland is not negotiated—he is dropping an atomic bomb on risk pricing models. I firmly believe we are at a point of exhaustion. Investors are so accustomed to the so-called Taco Trade (the notion that Trump always bluffs or backs down on extreme threats) that they are ignoring the fact that sentiment indicators, such as the AAII Bullish Sentiment, have hit 49.5%, the highest level in over a year. Complacency is the fuel for the impending disaster.

1. Arctic Geopolitics: Why Greenland is the Trigger

The intent to acquire Greenland is not merely a real estate eccentricity; it is a profound strategic move in a world where Arctic melting has opened new trade routes and revealed massive reserves of rare earth elements and critical minerals. I view this as the final evolution of “America First.” By threatening NATO with punitive tariffs, Trump is testing European cohesion at a moment when the continent is still reeling from the 15% tariffs imposed in August 2025.

The European Union’s reaction, led by Emmanuel Macron and the European Commission, was the activation of the “Big Bazooka”—the Anti-Coercion Instrument (ACI). This means Europe is ready to retaliate against American tech giants and agricultural products. The International Monetary Fund (IMF), via Chief Economist Pierre-Olivier Gourinchas, has already warned of an “escalation spiral” that could shave up to 1.2% off global GDP in 2026. I ask: how can indices sit at record highs when the bedrock of global trade is under such assault? The answer lies in collective denial.

2. The VIX Time Bomb: Asset Manager Positioning

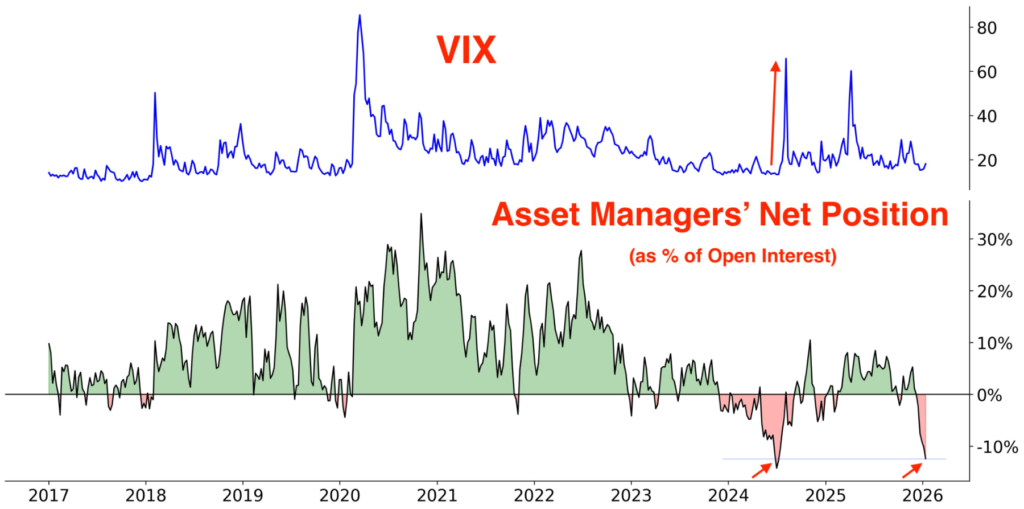

To understand why the impending drop will be so brutal, we must look at technical analysis and positioning data. Recent CFTC (Commodity Futures Trading Commission) data reveals something terrifying: asset managers and large hedge funds are holding the largest net short positions in the VIX in recent history.

As you can see in the charts I’m sharing, the percentage of short positions relative to open interest is at extreme levels. This indicates that the market is betting massively on continued calm. When everyone is on the same side of the boat, a single jolt—such as the confirmation of tariffs against Germany or the UK—will cause the boat to capsize instantly.

2.1. The Fear & Greed Index

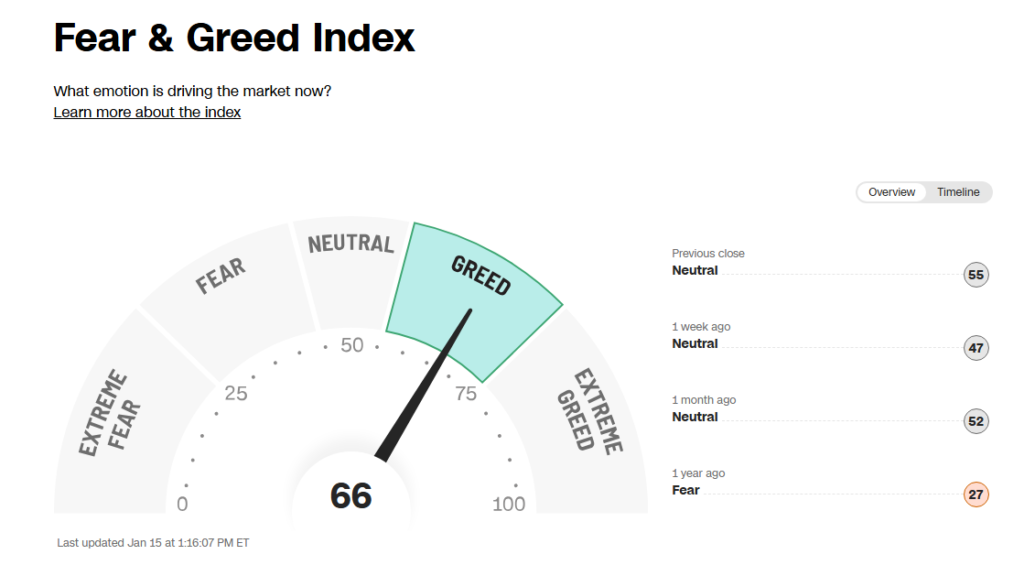

Currently, the Fear & Greed Index stands at 66 points (Greed). Historically, whenever we have surpassed a 40% rally in the indices over a 12-month period (which has occurred since the April 2025 tariffs), the market has searched for a catalyst to correct. Greenland is that catalyst. I do not know if the signing of the tariff decree itself will trigger the panic, but the market is too “stretched” to ignore tail risk any longer.

3. Comparative Analysis: 2025 vs. 2026 – The Weight of Tariffs

Below is a table summarizing the gravity of the current situation compared to last year’s tensions. It is vital to realize that the cumulative impact is what truly stifles growth.

| Risk Factor | 2025 Scenario (April/August Tariffs) | 2026 Scenario (NATO/Greenland Tariffs) | Estimated Impact |

| Base Tariff | 10% to 15% on specific goods | 10% to 25% on all goods (Allies) | Highly Inflationary |

| Geopolitical Target | China & EU Luxury Goods | Strategic NATO Allies | Fracturing of Military Alliances |

| Sentiment (AAII) | 35% Bullish | 49.5% Bullish | Extreme Complacency |

| VIX Positioning | Neutral / Hedged | Record Net Short Positions | Risk of Volatility “Short Squeeze” |

| Extra Catalyst | Post-Election Reopening | Capture of Maduro (Venezuela) | Commodity Instability |

4. The Venezuela Factor and the “Taco Trade”: Fact or Fiction?

We cannot analyze the Greenland issue in isolation. In early January 2026, we witnessed the capture of Venezuelan President Nicolás Maduro by U.S. forces. While shares of oil majors like Chevron and Exxon Mobil initially jumped on the prospect of “unlocking” Venezuelan oil, the real effect has been a surge in geopolitical tension with Russia and China.

Many investors are “buying the dip” based on the Taco Trade theory. They believe Trump is using Greenland merely as a bargaining chip to secure better terms for the USMCA (set for renegotiation in July 2026) or to force Europe to increase defense spending. I, however, disagree with this optimistic view. In 2026, the U.S. administration appears far more willing to “break” institutions to rebuild them. Mexico has already begun retaliating with tariffs of up to 50% on goods from China and other non-FTA countries, signaling that protectionism is now the rule, not the exception.

5. Portfolio Protection Strategies: How I Am Positioning My Capital

Given this scenario of ATH indices and irrational exuberance, my stance is one of absolute defense. This isn’t about exiting the market entirely, but about rotating into “unloved” safety nets and preparing for a massive volatility spike. Here is exactly how I am protecting my portfolio right now:

5.1. Buying Punished Sectors: The Case for Consumer Staples

While the crowd chases overvalued AI stocks, I am moving into sectors that have been unfairly punished but offer resilient cash flows. Consumer Staples are the ultimate bunker during a trade war. Specifically, I have built a significant position in General Mills (GIS). This company provides the “boring” stability that becomes gold when discretionary spending and tech valuations collapse under the weight of 25% tariffs. You can see the full breakdown of my thesis and my 2026 bet on General Mills here.

5.2. Going Long on Volatility (VIX)

As I mentioned earlier, the positioning in the VIX is a “crowded trade” on the short side. When everyone is betting against fear, I buy fear. I have established long positions in volatility to hedge against the “Greenland Detonator.” This is not just a speculative play; it is insurance for my entire equity portfolio. I’ve detailed my entry points and why I am long VIX in 2026 in this dedicated analysis.

5.3. Drastic Reduction of Leverage

If there is one lesson I’ve learned from past corrections, it’s that leverage kills when volatility returns. In a 2026 environment where interest rates remain stubbornly high and trade uncertainty is peaking, holding a margin balance is a recipe for disaster. I have aggressively decreased my leverage, prioritizing a clean balance sheet so that when the 20% correction inevitably comes, I have the dry powder to buy the blood in the streets rather than receiving a margin call.

FAQ: Frequently Asked Questions on Greenland Tariffs

Will the NATO tariffs actually go into effect in February 2026?

Yes, the official announcement sets the start date for February 1st at 10%. While there are legal challenges in the U.S. Supreme Court, the administration is utilizing the IEEPA (International Emergency Economic Powers Act) to ensure immediate implementation.

What happens to Tech stocks if Trade War 2.0 escalates?

The tech sector is highly sensitive to cost-push inflation and European retaliation (the “Big Bazooka”). High volatility is expected, particularly for companies reliant on European semiconductors or those with massive revenue exposure in the EU.

Should I sell all my stocks now?

No. The strategy should be rotation and protection. Hold companies with strong free cash flow and low debt, while using gold and volatility instruments to balance the risk.

Conclusion: The Price of Market Arrogance

In conclusion, the Greenland issue and the NATO tariffs are not an isolated event, but the final nail in the coffin of a market cycle that has become greedy and lazy. When we look at indices up over 40% since last April, ignoring the fact that we are on the verge of a trade rupture with our closest allies, we realize that a correction is not just likely—it is necessary for the health of the financial system.

I believe the coming months will bring a brutal “reality check.” My position is clear: protect your gains. Do not be the last one to exit a trade where every asset manager is shorting volatility. Greenland might be frozen, but the market is about to catch fire.

For a deeper look at Arctic power dynamics and their direct impact on assets, I highly recommend consulting the detailed reports on the 2026 Global Economy by the IMF. Stay vigilant, for volatility is merely the price we pay for uncertainty.

Disclaimer: This analysis reflects my personal opinion and does not constitute financial advice. Investing in financial markets involves high risk.