This analysis explores the tactical investment in TLT (US Treasuries 20+Y) and DJAD for 2026. With real-time inflation (Truinflation) at 0.95%, significantly below official BLS reports, and a yield curve undergoing a rapid “re-steepening,” I anticipate an economic slowdown driven by consumer debt and AI-led deflation. This strategy seeks to capture gains from falling interest rates and a strengthening Dollar (DXY), positioning for a capital rotation following an expected equity market correction.

In the current macroeconomic landscape of February 2026, where uncertainty is the only market certainty, I have decided to position my capital strategically—and, for many, contrarianly. My top investment pick for this month focuses on Long-Duration US Treasuries, specifically through the TLT ETF (or its European UCITS equivalent, DJAD). This isn’t merely a “flight to safety” play into American debt; it is a calculated move based on a convergence of technical and fundamental factors that, in my view, are setting the stage for a massive valuation swing. I don’t just invest on a whim; I put my money to work exactly where my analysis shows the most favorable asymmetric risk/reward profile.

Skin in the Game: Portfolio January 2026

1. The Strategic Timing: When to Buy Long-Term Bonds?

The fundamental question any serious investor must ask is: Where are we in the economic cycle? Historically, investing in US Treasury bonds with maturities of 10 to 20+ years reaches its peak profitability when the market begins to anticipate a sharp economic deceleration or an aggressive cutting cycle by the Federal Reserve.

As I write this, I firmly believe we are standing on that precipice. While the equity markets have largely ignored signs of fatigue, high-frequency data—such as that provided by Truinflation—tells a very different story than the official government narrative. When we forecast that inflation will fall sustainably—or even slip into deflationary territory—the nominal value of these bonds, which offer fixed coupons, becomes exponentially more attractive. It’s the classic “flight to quality,” but with an added steroid: the inevitable collapse of yields.

2. The Inflation Reality: Truinflation vs. The Official Narrative

As evidenced by the real-time data from Truinflation, the US CPI inflation index currently sits at a staggering 0.95%. While the Bureau of Labor Statistics (BLS) continues to report “sticky” rates hovering around 2.70%, the daily aggregated metrics from Truinflation, which utilize millions of data points in real-time, have already plummeted below the psychological 1% threshold.

This discrepancy is my margin of safety.

I contend that this deflationary trend is not a statistical fluke but the result of two unstoppable structural forces:

- The AI Effect: By 2026, Artificial Intelligence has reached a level of implementation that is inherently deflationary. It isn’t just slashing production costs; it is beginning to “hollow out” white-collar and technical jobs en masse. A diminishing wage base invariably leads to lower upward pressure on prices.

- Extreme Indebtedness: The average American consumer is currently backed against a wall. With interest rates having remained “higher for longer” for an extended period, the cost of servicing debt—credit cards, auto loans, and mortgages—has drained discretionary income. Since the US economy is roughly 70% dependent on domestic consumption, a choked consumer is the ultimate precursor to a recession.

3. Yield Curve Dynamics and the Looming Recession

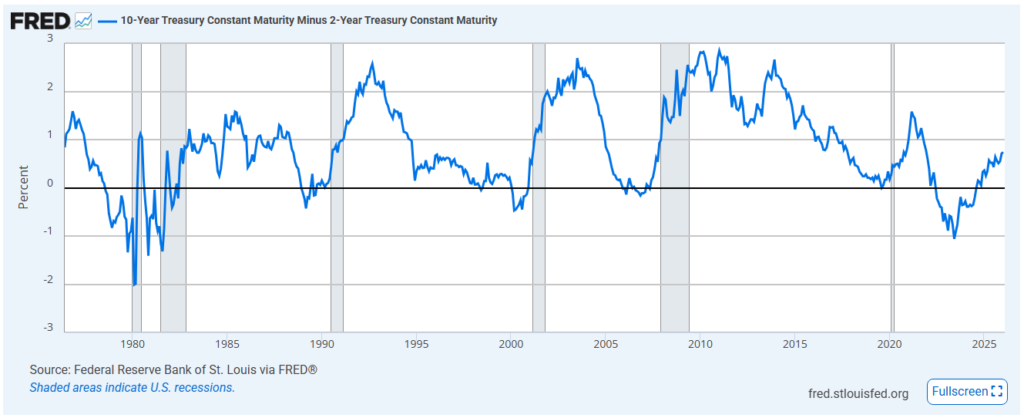

Analyzing the St. Louis Fed (FRED) chart regarding the spread between the 10-year and 2-year Treasury notes (10-Year Treasury Constant Maturity Minus 2-Year), we see a historical pattern that rarely fails. After a prolonged period of inversion—where short-term rates are higher than long-term rates—the rapid de-inversion (re-steepening) is the final signal that a recession has arrived.

The curve is currently “steepening” back into positive territory. Historically, this is precisely the phase where unemployment begins to tick upward and the Fed is forced to slash rates to prevent a systemic collapse. I believe that under the leadership of Kevin Warsh and under significant pressure from the Trump administration, the Fed will cut rates much faster than the market currently prices in. This environment is the “Golden Age” for the TLT.

| Asset Class | Low Inflation Scenario | Recession Scenario | Yield / Target |

| TLT / DJAD | High Appreciation | Maximum Protection | ~4.1% + Capital Gains |

| S&P 500 | Neutral/Negative | Sharp Decline | Low Dividend Yield |

| Cash (USD) | Purchasing Power Gain | Stability | Decreasing (Fed Cuts) |

4. Why I Chose DJAD and the “Dollar Bull” Advantage

Many ask me: “Why invest via DJAD if you can go directly into TLT?”. The answer lies in my geographical location and my outlook for the US Dollar (USD). For investors in Europe, DJAD (Lyxor US$ Treasury 10+Y) provides exposure to long-dated US debt while allowing the investor to benefit from currency fluctuations.

I am consistent with my convictions: I put my money where my ideas are.

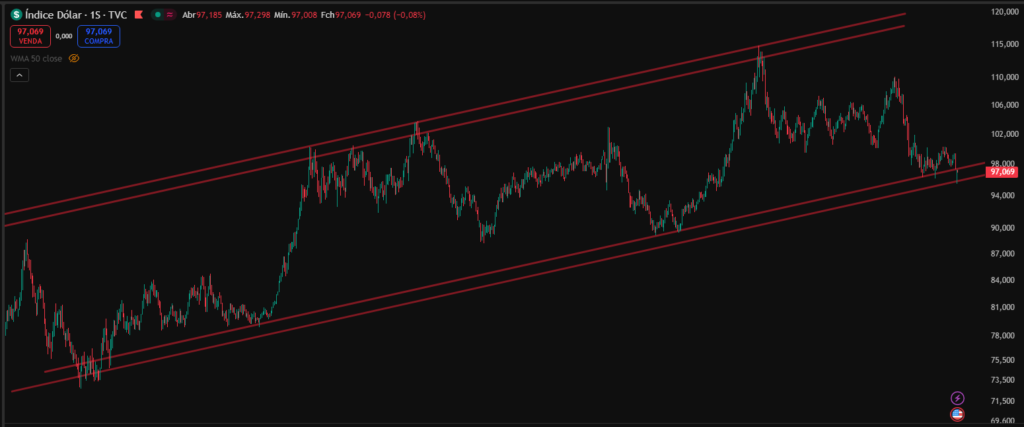

Looking at the Dollar Index (DXY) technical chart, it is evident that the greenback is trapped in a long-term ascending channel. We recently witnessed a weekly “rejection candle” exactly on the lower trendline of this channel, which clearly favors the “bulls.”

Despite the extreme pessimism I see in certain market circles regarding the dollar’s reserve status, I use this as a contrarian indicator. When everyone believes the dollar will collapse due to the deficit, the market tends to do the opposite—especially in a global crisis scenario where the USD functions as the ultimate safe haven. Therefore, the profitability of my position in this ETF benefits from two engines:

- The rise in bond prices (driven by falling interest rates).

- The appreciation of the Dollar against the Euro.

5. The End-Game: Capital Rotation by Late 2026

I do not intend to hold US Treasuries forever. My positioning in February 2026 is purely tactical. I believe the US economy has shown artificial resilience due to massive investment in Data Centers and AI, but this private investment bubble cannot sustain GDP indefinitely if consumption craters.

My thesis follows a strict timeline:

- Capture the 4.1% Dividend Yield while awaiting the asset’s appreciation.

- Realize capital gains as the 10-year yield gravitates toward 2% or 3%.

- Wait for the severe correction in equity markets (S&P 500 and Nasdaq) that I anticipate for the second half of the year.

- In that moment of peak panic—when TLT is at its zenith and stocks are “on sale”—I will execute a capital rotation: selling the safety of bonds to buy the generational opportunities that will appear in the stock market.

FAQ: Frequently Asked Questions on TLT Investing in 2026

Why does TLT rise when interest rates fall?

Bond prices have an inverse relationship with interest rates. Since TLT holds bonds with fixed coupons, if new market rates drop, the older bonds held by the ETF (with higher rates) become more valuable, driving up the ETF’s share price.

Isn’t US debt risk too high right now?

While the US deficit is a long-term concern, during periods of financial stress or recession, US Treasuries remain the most liquid and sought-after assets in the world. The risk of a short-to-medium-term default is virtually zero given the Fed’s ability to provide liquidity.

What is the difference between TLT and DJAD for a global investor?

TLT is the original US-listed ETF (iShares 20+ Year Treasury Bond). DJAD is a UCITS-compliant alternative available to European investors. It tracks US Treasuries with maturities over 10 years, providing the same USD exposure without the brokerage restrictions often associated with US-domiciled products for non-US residents.

Conclusion: My Final Stance

In summary, my move in February 2026 is a declaration of distrust in current market euphoria and a vote of confidence in economic mathematics. The Truinflation data does not lie: the war on inflation has been won, and the new enemy is deflation. With a Fed that will be forced to pivot aggressively (regardless of today’s hawkish rhetoric) and a Dollar showing technical strength in a multi-year channel, I am extremely comfortable in this position.

I will continue to monitor the charts and official reports from the Federal Reserve, but my path is set. I am protecting my wealth, securing an attractive passive income, and keeping my “dry powder” ready for the moment the equity market finally capitulates. If you want to navigate these waters, look past the headlines and focus on the raw data.

Would you like me to analyze a specific equity ETF for the future capital rotation I mentioned?