In 2026, DXY analysis suggests an atypical appreciation. Contrary to the consensus, the Fed’s rate cuts are actually bolstering the dollar, as falling yields attract foreign capital looking to capture capital gains in US10Y Treasuries. Within a sideways-bearish market, extreme pessimism surrounding the USD and contrarian sentiment are creating a prime technical buying opportunity at the long-term channel support (98-99 range).

I have never been one to follow the herd. In the world of finance, especially as we navigate 2026 with such a fragmented macroeconomic landscape, the ability to read what lies beneath the headlines is what separates a profitable trader from a mere spectator. If you listen to the analysts at the big investment banks, the narrative is almost unanimous: “The Federal Reserve is going to cut rates, so the dollar is bound to melt.” I am here to tell you they are wrong.

In this article, I am opening the doors to my public trading portfolio, detailing my thesis on the DXY, and explaining why my optimism regarding the U.S. Dollar isn’t just a “bet”—it’s a position rooted in capital flow mechanics that the market stubbornly chooses to ignore.

1. The Rate Paradox: Why Lower Interest Rates Could Strengthen the DXY in 2026

Classical economic theory teaches that lower interest rates make a currency less attractive. However, in my view, 2026 has introduced a different dynamic. When the Fed begins a cutting cycle, the price of Treasury bonds (fixed income) rises. For global investors, the opportunity to capture massive capital gains on 10-year notes (US10Y) is irresistible.

To buy these bonds, international capital must be converted into dollars. It is this massive inflow that sustains the DXY. I firmly believe that the quest for safety and nominal bond appreciation will outweigh the narrowing interest rate differential. While the world watches the “carry trade” die, I am watching the “safe haven” inflow and debt asset appreciation being born. This scenario is particularly critical when compared to the instability of other currencies, a topic I explored deeply in my article on the Yen Crisis and the Collapse of Sentiment in Japan.

2. DXY Technical Analysis: Testing a Decade-Long Support

When analyzing the charts attached to this analysis, the technical evidence is overwhelming. The U.S. Dollar is testing zones of historical value.

The Long-Term Chart (Monthly)

On the monthly chart (2004-2026), we see the DXY oscillating within an impeccable ascending channel. Notice how, at the start of 2026, the price touched the lower trendline in the 98.673 zone. To me, this is a “floor of steel.” Historically, every time the index has touched this base, we have witnessed violent recoveries toward the upper bound of the channel, above the 110 mark. The current pessimism is, technically speaking, a gift for contrarian traders.

The Short-Term Chart (Daily)

On the daily chart, we observe an interesting consolidation. The RSI (14) is at 62.06, indicating that buying momentum is gaining traction as it leaves oversold territory. The price is currently fighting to break above the WMA (30) and the horizontal resistance at 99.131. My analysis indicates that a sustained close above 100 will trigger a massive short squeeze, catching the market completely off guard.

3. Contrarian Sentiment Strategy and the Sideways Market

The year 2026 has been characterized by a sideways-bearish trend in global equity markets. When global indices fail to print new highs and volatility spikes, capital tends to seek refuge in the world’s reserve currency. I see this environment as the perfect ecosystem for the dollar.

There is extreme pessimism surrounding the dollar. “De-dollarization is coming,” they say. However, liquidity data from the Federal Reserve Bank of New York shows that USD dominance in SWIFT transactions remains unshaken. Trading against mass sentiment—especially when technical data supports a reversal—is where the highest profitability lies. Instead of chasing aggressive growth in risk assets, I have focused my exposure on resilient assets, as you can confirm in my Defensive Stock Portfolio (Focus on GIS).

4. Deep Dive into My Public Trading Portfolio

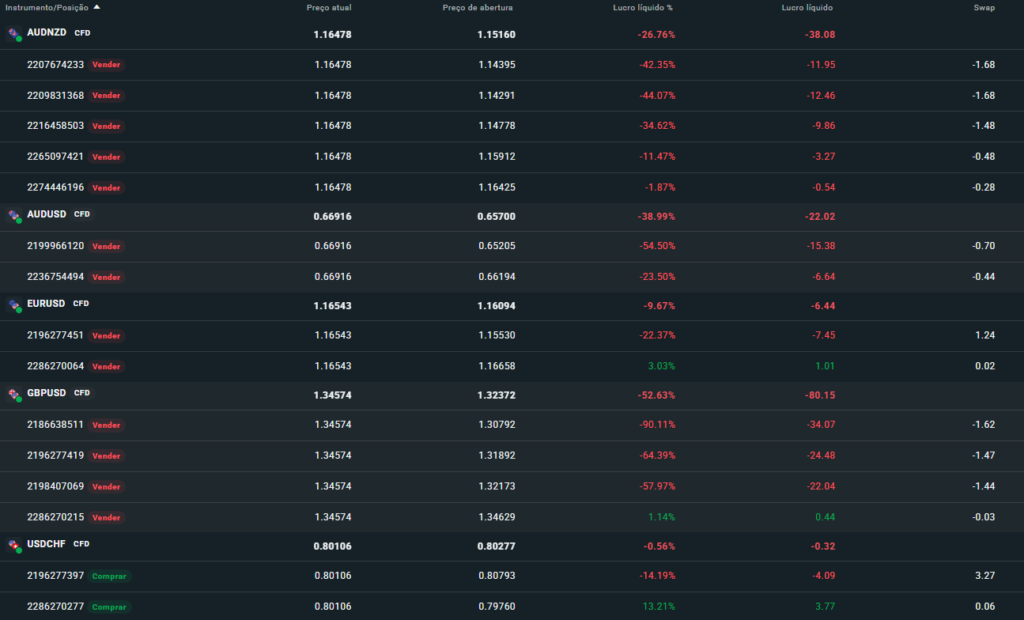

To leave no doubt about my conviction, I present below the current state of my positions. As you can see, my exposure is heavily “Long USD,” selling currencies that I consider overvalued or technically fragile.

Current Positions Table (January 2026)

| Instrument/Position | Opening Price | Current Price | Status / Thesis |

| EURUSD (Short) | 1.16094 | 1.16543 | Bearish on the Euro due to EU stagnation. |

| GBPUSD (Short) | 1.32372 | 1.34574 | Betting on Sterling weakness against USD strength. |

| AUDUSD (Short) | 0.65700 | 0.66916 | Proxy for commodity slowdown and USD resilience. |

| USDCHF (Long) | 0.80277 | 0.80106 | Expecting a Dollar recovery against the Swiss Franc. |

| AUDNZD (Short) | 1.15160 | 1.16478 | Arbitrage between Oceania currencies (Adjustment position). |

Important Note: As you can see on my trading dashboard, some positions like GBPUSD and AUDUSD are showing floating losses (drawdown). However, I hold these positions with total confidence. Trading requires the stomach to endure volatility while the macro thesis unfolds. The positive swap (carry) on several of these positions also helps maintain the strategy while we wait for the DXY breakout.

5. Conclusion: The Dollar Remains King of the Board

In short, my stance is clear: the dollar is not dead; it is merely catching its breath at the support of a 20-year channel. The convergence of falling yields (attracting capital to US10Y), extreme pessimism, and the “rounded bottom” technical structure on the daily chart points to a very strong second half of 2026 for the DXY.

Don’t be fooled by the media noise. A sideways-bearish market favors the holder of the reserve currency. I will continue to add to my dollar longs every time the index tests the 98-99 zone, as the risk-reward ratio is currently one of the best we’ve seen in the last decade.

Frequently Asked Questions (FAQ)

Why does the dollar rise if Fed rates go down?

Because falling rates increase the value of existing bonds. Foreign investors buy dollars to purchase these securities and lock in capital gains, creating massive buying pressure on the DXY.

What does a “sideways-bearish” market mean for the dollar?

It means stocks lack a clear upward trend and tend to drift lower. In these periods of uncertainty and low returns in risk assets, capital flows into the dollar as a safe haven.

Is it safe to trade against market pessimism (contrarian sentiment)?

Contrarian trading is an advanced strategy. In 2026, with everyone betting on a dollar collapse, any positive U.S. economic data causes a “short squeeze,” forcing bears to buy back their positions and driving the price up rapidly.

Legal Disclaimer: This article represents my personal opinion and my actual market positions. It does not constitute financial advice or an investment recommendation. Trading Forex and CFDs involves a high risk of capital loss. Always consult a certified financial advisor before making any investment decisions.