The silver market has taken center stage in the global financial landscape in early 2026, delivering a bullish performance that has caught even the most seasoned commodity traders by surprise. But what is truly driving this metal, which for years seemed to live in the shadow of gold? Are we witnessing a structural shift in the monetary system, or is this merely another speculative bubble fueled by tech narratives? In this article, I will dive deep into the fundamentals supporting this rally—from the impact of Artificial Intelligence to new geopolitical restrictions—while highlighting the technical red flags that demand caution for anyone looking to enter the market right now.

1. The Unshakable Fundamentals of Silver: AI and the Energy Transition

To understand why silver is skyrocketing, we must look far beyond its shine as jewelry. Silver is, above all, an industrial metal with irreplaceable physical properties. In 2026, two primary pillars support the voracious demand for this asset: the explosion of Artificial Intelligence (IA) infrastructure and the global energy transition. Silver’s electrical conductivity is the highest of all metals, making it essential for manufacturing advanced semiconductors, data center connectors, and the complex thermal management systems required to power large-scale language models.

Furthermore, the renewable energy sector continues to consume massive portions of the global silver supply. Next-generation solar panels and the accelerated electrification of the world’s automotive fleet require quantities of silver that current mining operations simply cannot match. We are living in a scenario where silver has transitioned from being a mere “portfolio hedge” to becoming the indispensable fuel of the modern technological revolution. Unlike other assets, industrial demand for silver is inelastic; companies need it for their equipment to function, regardless of the market price.

2. Structural Scarcity: Where Are the Ounces?

The reality of the physical market is alarming for consumers and exhilarating for holders. Silver has been in a structural supply deficit for five consecutive years. Most silver production occurs as a byproduct of mining other metals, such as copper and zinc. This means that even if the price of silver moonshots, mining companies cannot immediately ramp up production, as they depend on the economic viability of their primary base-metal mines.

Recent data indicates that inventories in major global exchanges, such as the COMEX and LBMA, have reached critically low levels. When examining physical stock charts, the trend is aggressively downward, contrasting violently with the upward price curve. This real-world scarcity creates a fertile environment for “short squeezes” and volatility spikes, where any news of supply chain disruption can catapult the value of an ounce in a matter of hours.

3. New CME Rules and China’s Strategic Export Limits

Recently, the market was rattled by significant regulatory interventions. The CME Group (Chicago Mercantile Exchange) announced successive increases in margin requirements for silver futures. In practice, this means investors must deposit more capital to maintain their leveraged positions. While the CME justifies these measures as a way to curb volatility, many analysts view this as a desperate attempt to slow down a bullish momentum that was threatening to spiral out of control.

Parallel to this, China, which holds a tight grip on much of the global metal processing, implemented new restrictions on silver exports effective January 1, 2026. Beijing has limited the number of companies authorized to export the metal and raised eligibility criteria, treating silver with the same strategic rigor applied to rare earth elements. This geopolitical maneuver reduces liquidity in the Western market and forces prices higher as arbitrage between Shanghai and the rest of the world becomes increasingly complex and expensive.

4. Protection Against Fiat Currency and the Unsustainable U.S. Debt

Historically, precious metals have served as the ultimate refuge against the devaluation of fiat currencies. In 2026, this narrative has never been stronger. With the United States national debt reaching levels that many economists consider mathematically impossible to repay through traditional means, confidence in the U.S. dollar is being tested. As seen in the FRED (Federal Reserve Economic Data) charts, the debt trajectory is now parabolic.

“When governments print currency to cover endless budget deficits, the purchasing power of that currency is diluted. Silver, being a physical and finite asset, cannot be printed or debased.”

This perception of systemic risk is pushing large institutional funds and retail investors alike toward silver. If the paper-based financial system starts to show cracks, investors seek “real money.” Silver offers that security, with the added benefit of a much more accessible entry point than gold, allowing the middle class to protect their savings against the rampant inflation eroding bank deposits.

My Market Vision: Long-Term Opportunity, Immediate Danger

We have reached the point where I share my personal reading of the markets, based on the data and charts provided. I firmly believe that, in the long run, silver has all the ingredients to continue its upward trajectory and potentially test new all-time highs. The fundamentals of scarcity, technological demand, and the sovereign debt crisis are powerful engines that will not disappear overnight.

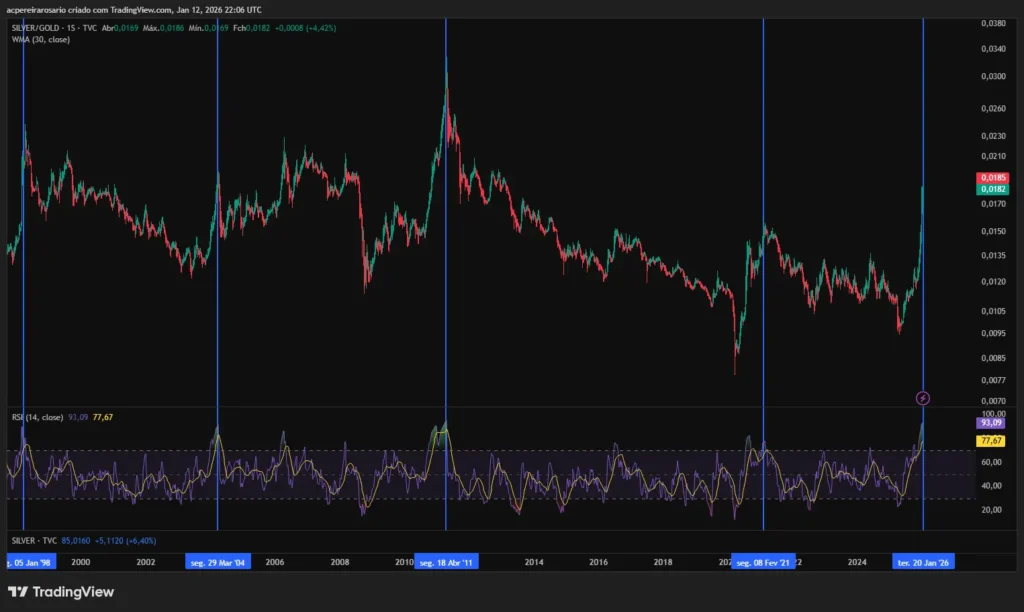

However, I must issue a serious warning for the short term. If we look at the Silver/Gold ratio chart associated with the weekly RSI (Relative Strength Index), we notice something deeply concerning: the indicator has crossed the 80-point threshold. Historically, whenever the RSI reaches these levels of extreme overbought conditions, the market undergoes severe and painful corrections.

- Silver goes up the stairs and down the elevator.

- An RSI above 80 indicates that the current move may be emotionally exhausted.

- Corrections of 15% to 25% are common following parabolic rallies like this.

Therefore, my stance is one of extreme caution. While I view silver as an essential asset for any wealth preservation portfolio in 2026, buying at the peak of a vertical move—with technical indicators “screaming” overbought—is a risk that must be managed carefully. The smart investor waits for the pullback, takes advantage of the panic from those who bought at the top, and accumulates when the RSI returns to equilibrium zones.

Conclusion

Silver is experiencing a historic moment, driven by a perfect storm of technological industrial demand, physical scarcity, and global macroeconomic uncertainty. China’s restrictions and the CME’s maneuvers only add fuel to a fire that was already burning bright. Yet, financial markets are cyclical. In the long run, the investment thesis for silver is among the most solid I have seen in decades, but those who ignore technical signs of exhaustion in the short term risk seeing their capital evaporate in a necessary technical correction.

Protect your wealth, but do so with a strategy. Silver is real money, but timing is what separates the successful investor from the frustrated speculator.

Continue reading the following article: The Civil War at the Federal Reserve

Disclaimer

The information provided in this article is for informational and educational purposes only and does not constitute financial, investment, or legal advice. Investing in commodities and precious metals involves significant risk. You should conduct your own research or consult with a qualified financial professional before making any investment decisions. The author is not responsible for any financial losses resulting from the use of this information.