In January 2026, as gold hits $5,000 and silver touches $100, an existential paradox emerges for investors. While technical indicators suggest a bull market, fundamental shifts driven by AI and space exploration point toward total asset obsolescence. Elon Musk’s 2026 Davos address signaled the end of scarcity-based economics. With industrial silver being replaced by nanotech copper and the looming threat of asteroid mining, the intrinsic value of precious metals faces a potential terminal collapse.

I look at the screens on my financial terminal today and see a level of euphoria that honestly terrifies me. Watching gold break $5,000 and silver stabilize at $100 per ounce feels like the ultimate dream for every “gold bug” and conservative investor finally coming true. However, while the masses celebrate what they call the “final victory against fiat currencies,” I feel a deep sense of unease. What if we are witnessing, not the triumph, but the siren song of an asset class about to become irrelevant?

I firmly believe that the future awaiting us in the next few years is radically different from anything humanity has experienced in the last five millennia. For centuries, gold was the standard of value because it was scarce, indestructible, and difficult to obtain. But in a world dominated by Super-Human Scale Artificial Intelligence (AI) and the imminent reality of commercial space exploration, those properties transition from advantages to liabilities. Gold, after all, is just a rock. It produces nothing, yields no dividends, and unlike a tech company that generates solutions and productivity, gold simply “exists.” In this 2026 landscape, where productivity is exploding thanks to automation, keeping capital stagnant in “rocks” might be the greatest strategic error of our generation.

1. The Davos Shock: Elon Musk and the Death of the Money Concept

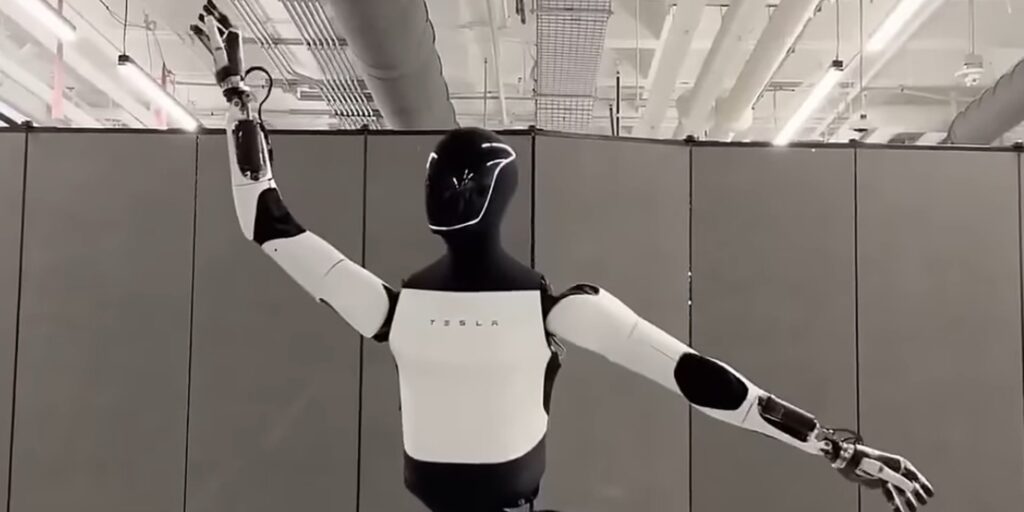

This week, the world stopped to listen to Elon Musk at the World Economic Forum in Davos. The man who achieved the “impossible”—landing rockets autonomously and spearheading the electric revolution—dropped a rhetorical bomb that few in traditional financial markets have correctly processed. Musk categorically stated that with the maturity of AI and robotics (with his Optimus robot entering mass production), money will cease to be important.

His reasoning is ruthlessly logical: money is merely a database for the allocation of resources and labor. If AI and robots can perform any human task at a marginal cost approaching zero, scarcity effectively disappears. And if scarcity vanishes, the utility of a “store of value” like gold or silver evaporates. If anyone else said this, I would dismiss them as economically illiterate. But we are talking about the world’s wealthiest individual, the architect of the future. If he claims we are moving toward an abundance-based economy where the secondary importance of money becomes the norm, who are we to bet our future on metals that depend strictly on the perception of scarcity?

If money stops being the central mechanism of power and survival, why would we want to hoard gold and silver? It makes far more sense to hold productive assets—AI infrastructure, stellar energy arrays, or highly specialized human capital—than a metal that is notoriously difficult to transport off-planet. Imagine the scenario: as we colonize Mars and the Moon, who will want to haul tons of heavy metal through the vacuum of space when the real value lies in processing power and energy density?

2. The Silver Illusion: When Price Kills Industrial Utility

Many argue that silver is different because of its industrial component. It is true that silver possesses unique conductive qualities. However, we have reached a breaking point. With silver at $100 per ounce, the cost for the solar panel and electronics industries has become unsustainable. The technical analysis I previously published regarding Silver at $100 and Gold at $5,000 predicted this pressure, but technological reality has outpaced even those expectations.

Industry does not sit idly by while profit margins vanish. Recent reports from the World Economic Forum and industry giants like LONGi Green Energy indicate that large-scale substitution is already being implemented.

Comparative Table: Silver vs. Technological Alternatives (2026 Scenario)

| Material | Relative Cost | Conductivity | Implementation Status (2026) |

| Silver | 100x | 100% (Excellent) | Rapidly being phased out due to price. |

| Copper (Nanotech Pastes) | 1x | 95% (Very Good) | Mass production in TOPCon and HJT solar cells. |

| Graphene / Carbon Nanotubes | 5x | 110% (Superior) | Final testing for high-end microelectronics. |

| Specialized Aluminum | 0.5x | 61% (Average) | Used in low-cost components and power grids. |

As the data shows, at $100, silver ceases to be a raw material and becomes an unnecessary luxury. Science has found ways to use copper pastes and graphene deposition technologies that render silver obsolete. The “industrial use” argument that sustains the silver bull thesis is crumbling. If the industry stops buying, what remains is a saturated investment market that could collapse the moment the narrative shifts from “scarcity” to “obsolescence.”

3. Asteroid Mining: An Inundation of Gold from the Heavens

We are closer than ever to commercial space exploration. NASA and private entities like SpaceX and Blue Origin have already set their sights on asteroids like 16 Psyche. Official estimates from NASA suggest that this single asteroid contains precious metals worth quadrillions of dollars.

- Infinite Gold: If a single celestial object brings back the equivalent of ten times all the gold ever mined in history, the price of the metal won’t just drop—it will go to zero.

- Space Logistics: As I mentioned, gold is heavy. In an interplanetary economy, the currency of exchange will be energy (kWh) or computing power (FLOPS). Holding a gold bar in a Martian habitat is like owning an expensive paperweight that cost a fortune to transport.

I believe in this future, and I believe it is closer than many imagine. Those aggressively buying gold at $5,000 might be buying the top of a five-thousand-year bubble. Technology does not respect tradition. Technology destroys scarcity, and gold is the favorite child of scarcity.

4. The End of Labor and the Relevancy of Capital

Artificial Intelligence isn’t just changing how we invest; it is changing the very structure of society. We now have full approval for Level 5 Autonomous Driving. Think about the millions of truck drivers, chauffeurs, and delivery workers. Who will hire a human driver, who needs sleep, food, and benefits, when they can have an electric truck that works 24/7 with perfect efficiency?

This mass displacement of labor will force a redefinition of value. If human labor ceases to be the basic unit of the economy, money (and the metals that protect it) loses its primary function. We are entering the era of AI-generated Universal Basic Income. In this new paradigm, protection against “fiat printing” is irrelevant because the financial system itself will have to be rebuilt on foundations other than debt and scarcity.

“AI will make goods and services so cheap that the concept of ‘wealth’ as we know it today will be seen as a barbaric relic.” — This is the vision now echoing through the halls of power, and I share it.

FAQ: The Future of Precious Metals

Can gold actually go to zero?

Yes, if its utility as a store of value vanishes due to abundance (space mining) or if digital infrastructure makes physical assets obsolete for an interplanetary economy.

Isn’t silver essential for the energy transition?

It was. With silver at $100, solar industries shifted to copper and graphene. Industrial dependence on silver is dropping drastically in 2026.

What does Elon Musk say about gold?

Musk views precious metals as an inefficient way to allocate resources. For him, real value lies in processing capacity, energy, and multi-planetary life.

Should I sell all my gold now?

This is a long-term analysis of technological obsolescence. In the short term, volatility may continue to push prices up, but the risk of an “abundance shock” has never been higher.

Conclusion: A Paradigm Shift Without Precedent

In short, we are living through a historic moment where the past and the future are colliding violently. On one hand, we have the traditional financial system, terrified of inflation and currency devaluation, seeking refuge in gold and silver. On the other, we have the technological frontier, led by figures like Musk and fueled by AI, telling us that scarcity is an engineering problem about to be solved.

I believe in this technological future. I believe that gold, in a few years, will be viewed as a historical curiosity—a rock that once served to measure wealth in an era of limitations. If space mining becomes viable and if AI replaces the need for money as we know it, those “clinging” to physical metals could lose everything. The future belongs to those who invest in productivity, innovation, and intelligence, not those betting on the hope that the world will remain scarce and primitive.

Gold at $5,000 and silver at $100 may very well be the last gasp of a dying system. Before you invest every cent into these assets, ask yourself: Am I investing in the world that was, or the world that will be?