As of January 2026, investing in General Mills (GIS) stands out as a high-value defensive strategy. With a monthly RSI at 24.83 (historic oversold levels) and a 50% drawdown from its peaks, the company currently trades at a 9.5x P/E with a 5.47% Dividend Yield. While the S&P 500 faces stretched valuations (22x forward P/E), GIS, along with CSU and NVO, offers a rare entry window following severe corrections in the consumer staples and healthcare sectors.

My journey through the financial markets has always been guided by a maxim that many seem to forget during moments of euphoria: real profit isn’t made by buying what everyone wants, but by buying what everyone despises. Today, January 14, 2026, I look at the global landscape and see a scenario that deeply concerns me. The general market is expensive, excessively optimistic about technological promises that haven’t fully converted into free cash flow, and that is precisely why I’ve decided to open the books on my real investment portfolio. Investing in General Mills (GIS) has become, for me, not just a diversification option, but a strategic necessity for protection and yield amidst the macroeconomic instability I foresee for the rest of the year.

This is the first in a series of three detailed articles where I will dissect the composition of my long-term portfolio. Although the central focus today is General Mills, I cannot ignore that my current strategy is a “barbell” designed for resilience: on one side, I maintain my conviction in the secular growth of giants like Constellation Software (CSU) and Novo Nordisk (NVO); on the other, I am heavily loading up on defensive companies that the market seems to have irrationally abandoned. GIS is my primary position in this non-cyclical sector, and I will explain, with technical and fundamental detail, exactly why I am swimming against the current while the S&P 500 flirts with dangerous multiples of 22 times forward earnings.

1. The 2026 Defensive Pivot: Why Flee the Herd?

We are living through an early 2026 marked by a dangerous dichotomy. On one hand, global indices are touching all-time highs, driven by a “soft landing” narrative that, in my personal opinion, is far too fragile to withstand the supply shocks and trade tensions currently emerging. On the other hand, the consumer staples sector—the traditional safe haven for smart investors—is trading at multiples we haven’t seen since the 2008 financial crisis. I have chosen my side. I am preferring defensive companies because the risk premium in the tech sector has become stifling, and the margin of safety has vanished for those entering now. The Jamie Dimon Paradox and Trump’s Populism.

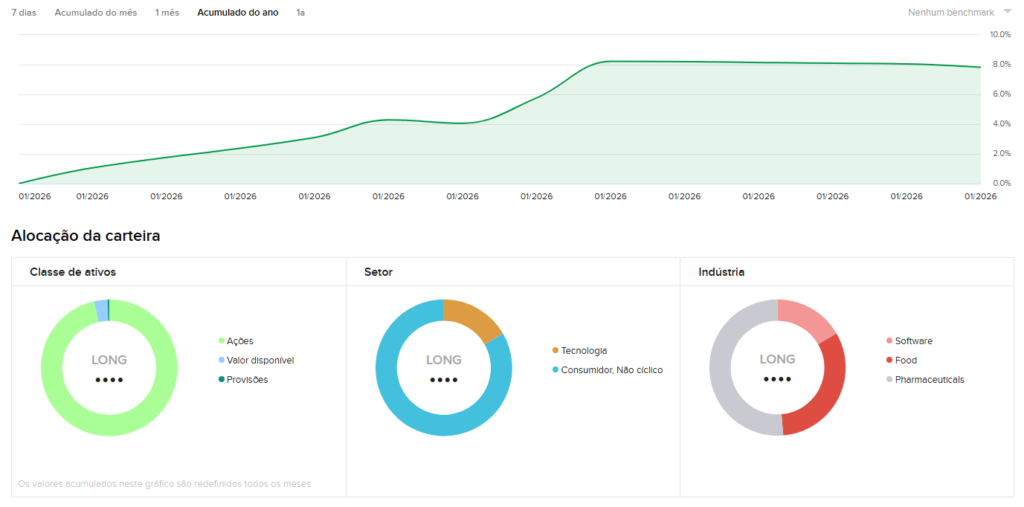

When looking at my investment portfolio, you’ll notice that I’ve already accumulated a gain of approximately 8% in just these first two weeks of January, but that gain doesn’t come from chasing “hype.” It comes from early positioning in assets that were slaughtered in 2025. General Mills is the perfect example of what I call a “forgotten company.” While analysts from the Fed and the ECB debate whether inflation is finally tamed or if new consumer taxes will slow down GDP, GIS has been doing the quiet homework: adjusting prices, optimizing its supply chain, and focusing on recovering organic sales volume. To me, the market is ignoring this company’s massive cash-generating capacity simply because it doesn’t have “explosive” growth or AI in its name.

1.1 The Psychology of Buying “Abandonment”

It is psychologically difficult to buy a stock that has dropped 50% while the rest of the market rises. I feel that pressure, but this is where fundamental analysis separates itself from emotional speculation. GIS is a food giant that owns brands we all have in our pantries: Cheerios, Häagen-Dazs, Nature Valley, and Blue Buffalo. People don’t stop eating or feeding their pets because interest rates are high or because the economy has slowed. On the contrary, during moments of severe correction—which I predict is highly likely in this 2026—this is the “bread and butter” stock that institutional capital desperately flees to in search of dividends and stability.

2. General Mills (GIS): A Sleeping Giant in the Food Sector

To understand why I am so convinced, we need to look at the “engine” of General Mills. Founded over 150 years ago, the company has survived every conceivable crisis. In 2026, its strategic focus is on the “Remarkability Strategy,” investing heavily in innovation so that at least 25% of its total sales come from products launched in the last few years. This adaptability is its greatest moat.

The company operates in four main segments that balance its ledger:

- North America Retail: Where cereals and snacks reside, ensuring a constant cash flow.

- Pet Food: Through Blue Buffalo, GIS has positioned itself in premium pet nutrition, a sector that has proven “recession-proof” in recent economic cycles.

- Foodservice: Direct sales to the hospitality and restaurant sector, which regained vigor in 2025.

- International: A global presence that allows for the mitigation of risks specific to a single geography.

What attracts me most to GIS today, in mid-January 2026, is its relative valuation. While the tech sector trades with an average P/E above 30x, General Mills is being offered at values that scream opportunity. Recently, the company reported earnings that beat analyst expectations ($1.10 EPS vs. $1.03 expected), but its forward guidance was conservative, which spooked short-term investors and created the perfect entry point for someone who, like me, looks at the next 5 to 10 years.

Table: Fundamentals and Projections – General Mills (GIS) in 2026

| Metric | Current Value (Jan 2026) | FY 2026 Projection | FY 2027 Projection |

| Stock Price | $44.33 | $52.00 (Avg Target) | $63.00 (Bull Case) |

| P/E Ratio (Forward) | 9.52x | 10.8x | 12.1x |

| Dividend Yield | 5.47% | 5.60% | 5.90% |

| EPS (Earnings Per Share) | $4.65 (TTM) | $3.79 (Guidance) | $4.15 (Est.) |

| Monthly RSI | 24.83 | Predicted Reversal | Stabilization |

Source: General Mills, Inc. – Stock Information, InvestingPro, and proprietary technical analysis (January 2026).

As you can see in the table, we are talking about a dividend yield exceeding 5% in an asset with extremely low credit risk. For me, this is the equivalent of being handsomely paid to wait for the market to regain its sanity and realize that companies generating real profit are worth more than promises of infinite growth.

3. Technical Analysis: The Scream of the Monthly RSI and Sell Exhaustion

If fundamentals tell us “what” to buy, technical analysis tells us “when” to act. And honestly, the GIS charts I am analyzing today would excite any value investor. The stock has suffered a drop of over 50% from its peaks, entering territory of total despair for sellers. On the monthly chart, the scenario is one of total capitulation.

The indicator that most sustains my position is the Monthly RSI (Relative Strength Index), which currently sits at 24.83. For those unfamiliar, a monthly RSI below 30 for a Blue Chip quality company is a very rare event.

Historically, whenever GIS has reached these oversold levels, a mean reversion followed with an average recovery of 20% to 30% over the next 12 months. I am not trying to guess the “bottom”—that’s for amateurs—but I am positioning myself in a zone where the statistical probability of a trend reversal is massive. The price is so far removed from its long-term moving averages that the “spring” is stretched to its limit; any positive news regarding volume recovery in 2026 will be the catalyst for a rapid move up.

3.1 The Carnage in CSU and NVO: Opportunity in Growth

What makes my investment portfolio particularly interesting in early 2026 is that the sell-off wasn’t limited to defensives. It is fascinating—and for many, terrifying—to observe that growth giants like Constellation Software (CSU) and Novo Nordisk (NVO) have also suffered massive stock market declines in recent months.

Both companies currently find themselves with monthly RSIs at oversold levels and, for the first time in years, feature significantly lower P/E multiples. In the case of NVO, pressure on obesity drug pricing (Wegovy/Ozempic) in the U.S. caused the stock to lose its historic premium, now trading at around 14x forward earnings—an unthinkable value two years ago. Meanwhile, CSU, my favorite “acquisition machine,” saw its multiple contract as the market began to question the sustainability of its model in a structurally higher interest rate environment. To me, this isn’t a signal to exit, but a confirmation that the market is “clearing the excess” indiscriminately, allowing me to build positions in elite assets at bargain prices.

4. The 2026 Scenario: Why a Severe Correction Could Be Your Best Friend

I am not a pessimist by nature, but I am a keen observer of debt cycles. The market in 2026 is dangerously stretched. The Price-to-Sales ratio of the S&P 500 and the concentration in “Big Tech” have reached levels that preceded almost every major correction of the last century. With inflation proving “sticky” due to energy costs and new global trade tariffs, the margin of error for growth companies is zero.

In this “perfect storm” scenario, General Mills functions as my financial life insurance. While the semiconductor or software sectors might drop 10% in a single panic session, GIS has a consumer base that has no choice but to buy its products. Its pet food brand, Blue Buffalo, is a clinical example of resilience: 2025 data shows that pet owners prefer to cut back on their own leisure before lowering the quality of food for their dogs and cats. This margin stability is what allows me to stay calm when financial headlines start screaming “Crash!”.

“In 2026, true intelligence isn’t in predicting the future, but in being prepared for any present.” — This is the conviction guiding my current allocation.

5. FAQ – Frequently Asked Questions About My 2026 Strategy

Can General Mills (GIS) drop further even with a low RSI?

Yes, but the risk-reward is highly favorable. In the market, nothing is guaranteed, but a monthly RSI at 24 and a P/E of 9x indicate that most of the “poison” has already been expelled. The downside risk is much lower than the upside potential when the mean is eventually retaken.

Why hold CSU and NVO if they are also falling?

Because they are exceptional quality companies on sale. The drop in CSU and NVO isn’t due to a deterioration of their business models, but a recalibration of market expectations. Buying these companies with low P/Es and RSIs at decade lows is the foundation for market-beating compounded returns in the long run.

Is the GIS dividend sustainable with the drop in earnings?

The GIS payout ratio remains healthy at around 50-55%. Even with the downward revision of EPS to $3.79, the company generates more than enough free cash flow to maintain and even slightly increase its dividends, as it has done for decades.

Conclusion: My Final Vision for the Portfolio

To conclude this first part of my investment portfolio analysis, I want to leave a message of pragmatism. Investing in January 2026 requires stomach and a vision that extends beyond the next quarter. My heavy position in General Mills (GIS) is a bet on fundamental rationality against technical euphoria. While the world chases ethereal promises, I am anchoring my wealth in assets that have real brands, real factories, and real profits.

The 50% drop in GIS and the multiple contraction in CSU and NVO are not signs of defeat, but the invitation to the value investor’s party. If a severe correction hits the market broadly later this year, this triad of companies—led today by the defensive nature of GIS—will be my greatest fortress. In the next articles, I will delve into how Constellation Software and Novo Nordisk complement this “offense and defense” strategy, but today, the lesson is clear: true value is hidden in abandonment.

Would you like me to analyze the role of Constellation Software (CSU) in my portfolio next to see how I’m leveraging the 2025/2026 drop to bolster my tech growth?

See my investment portfolio video here:

Legal Disclaimer: This article reflects only my personal opinion and the composition of my real investment portfolio as of January 14, 2026. None of the information contained herein should be interpreted as financial advice or a recommendation to buy/sell assets. Investing in financial markets involves high risks of capital loss. You should always conduct your own research (Due Diligence) or consult a certified financial advisor before making any investment decision. Past performance and projections are not guarantees of future results.