Microsoft (MSFT) remains the cornerstone of the global digital economy, reporting $281.7 billion in revenue for FY2025 and a 17% growth rate in Q2 2026. With an operating margin of 45.6% and an infrastructure-level lead in AI through Azure and its 49% stake in OpenAI, the company justifies its 27.5x P/E ratio. The recent 20% correction from all-time highs provides a strategic entry point for investors prioritizing quality and compounding growth.

The recent volatility in the financial markets has scared away the more cautious retail investors, but for those of us who analyze fundamentals with a multi-decade perspective, this is the time to strike. I am starting a position in Microsoft (MSFT) with the firm conviction that I am acquiring more than just a software company; I am buying the operating system of the future. Looking at the current 2026 landscape, it is undeniable that Microsoft has positioned itself at the epicenter of the greatest technological paradigm shift since the invention of the internet: the diffusion of Artificial Intelligence (AI).

Many analysts point to a demanding Price-to-Earnings (P/E) ratio of 27.5x for this year as a sign of overvaluation. However, my investment thesis is built on the premise that extreme quality and operational resilience justify this premium. When a company manages to maintain growth rates in the 17% range while operating with margins that would be the envy of any luxury sector, today’s price becomes tomorrow’s “discount.” The 20% correction from recent highs is, in my view, a market offering that I simply cannot ignore.

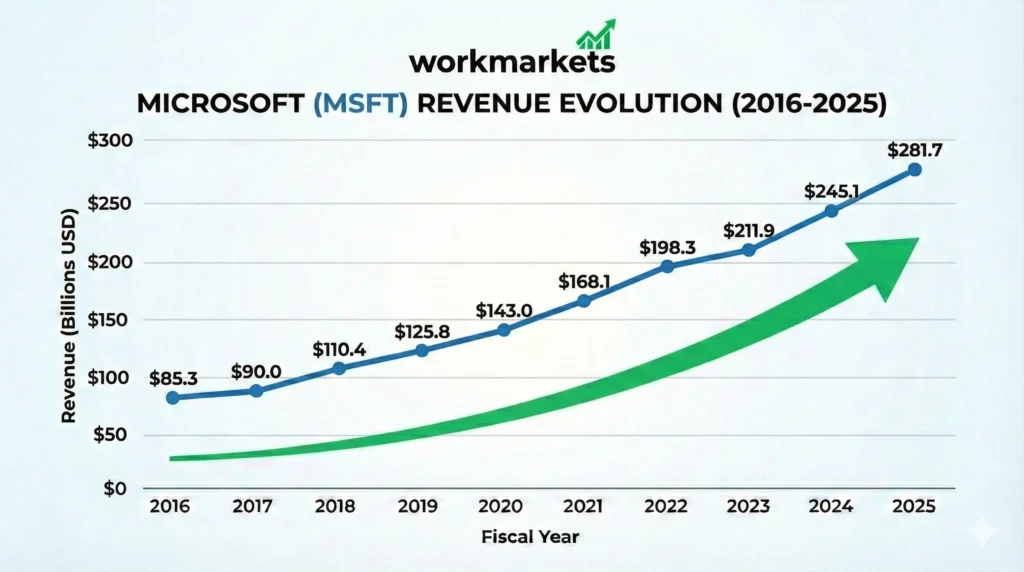

1. The Evolution of Revenue: The Azure Engine and the Intelligent Cloud

When analyzing Microsoft’s revenue history, it becomes evident that the company is not a static giant but a constantly accelerating organism. Over the past five years, we have witnessed consistent climbs, culminating in the $281.7 billion in revenue reported in 2025, a 15% increase over the previous year. This growth is not organic by luck; it is the result of a massive bet on the cloud and the transition to subscription models.

In the second quarter of fiscal year 2026 (ended December 2025), Microsoft reported revenues of $81.3 billion, a 17% growth compared to the same period last year. The absolute standout is Microsoft Cloud, which surpassed $50 billion in revenue in a single quarter. Azure, specifically, grew 34% in 2025, consolidating itself as the group’s most powerful growth engine.

| Fiscal Year | Revenue ($ Billions) | YoY Growth | Earnings Per Share (EPS) | Operating Margin | Stock Buybacks ($ Billions) | Dividends Paid ($ Billions) |

| 2021 | 168.1 | 18% | 8.05 | 41.6% | 27.4 | 16.5 |

| 2022 | 198.3 | 18% | 9.65 | 42.1% | 32.7 | 18.1 |

| 2023 | 211.9 | 7% | 9.68 | 41.8% | 22.2 | 19.8 |

| 2024 | 245.1 | 16% | 11.80 | 44.6% | 19.1 | 21.8 |

| 2025 | 281.7 | 15% | 13.62 | 45.6% | 20.4 | 24.3 |

Data based on 2021-2025 annual reports and Q2 2026 results.

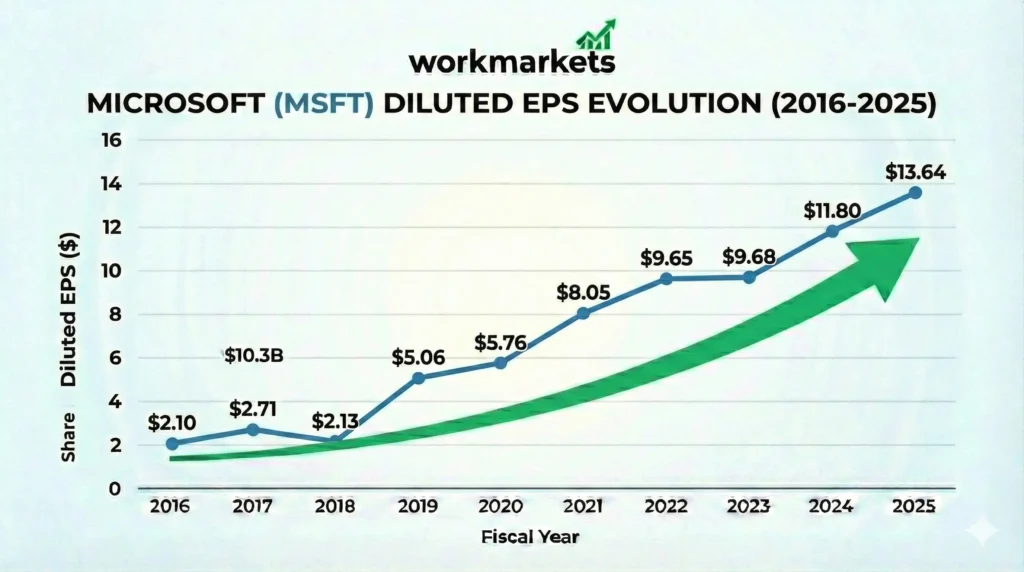

2. Earnings Per Share (EPS): The Magic of Scaled Efficiency

EPS (Earnings Per Share) is, for me, the ultimate metric of an investment’s health. What fascinates me about Microsoft is its ability to grow profits faster than revenues—a clear sign of operational leverage. In 2025, EPS stood at $13.62, a significant jump from $8.05 in 2021.

More recently, in Q2 2026, diluted EPS (non-GAAP) reached $4.14, representing a 24% growth. This performance is extraordinary and validates my decision to buy. I believe that with projected growth of 17% annually for the next five years, Microsoft will continue to surprise the market, especially as the integration of AI into the Office 365 ecosystem (via Copilot) begins to generate almost pure incremental margins.

Microsoft’s Free Cash Flow is the ultimate engine of its financial sovereignty, enabling massive AI infrastructure expansion while consistently fueling shareholder returns through dividends and buybacks. Even amidst record-breaking CapEx, the company’s ability to generate tens of billions in hard cash highlights an operational efficiency that separates market promises from industrial reality. This relentless “cash machine” provides me with the conviction to buy and hold, as its limitless financial flexibility ensures dominance across any economic cycle or technological shift.

3. Operating Margins: The Power of Software and AI

Microsoft’s margins are what I call a “financial fortress.” Watching the operating margin rise from 41.6% in 2021 to 45.6% in 2025 is a testament to the cost discipline of Satya Nadella’s team. Even with colossal investments in infrastructure (CapEx), the company manages to become more efficient with every dollar earned.

In the 2025 report, operating income grew 17%, reaching $128.5 billion. This profitability allows the company to finance its own technological revolution without relying excessively on expensive external debt, maintaining an enviable positive balance sheet. The integration with OpenAI (in which Microsoft holds a strategic stake of approximately 49% of the profits of the for-profit entity) allows it to be at the forefront without having to bear all the R&D risks alone.

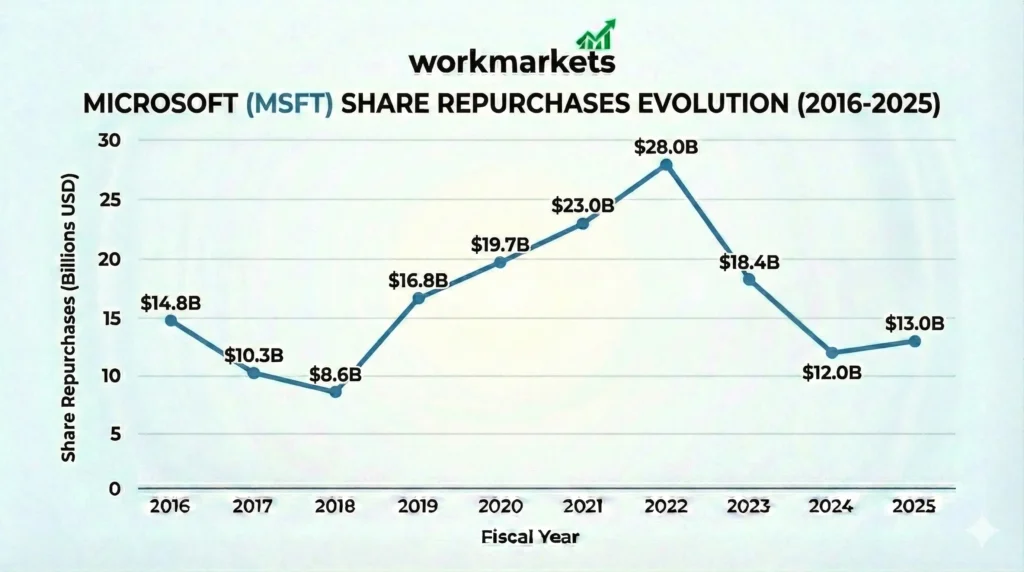

4. Shareholder Returns: Consistent Buybacks and Dividends

One of the central points of my thesis is the exemplary treatment Microsoft affords its shareholders. While many tech companies burn through cash, MSFT gives it back. In 2025, $24.3 billion in dividends were distributed and $20.4 billion in stock buybacks were executed.

This history of growing dividends and aggressive buybacks reduces the number of shares in circulation, mechanically increasing the value of each share I hold. I immensely value a company that, despite investing billions in data centers and silicon, does not forget to reward those who entrust it with their capital. It is this combination of growth and income that makes MSFT an essential component of any balanced portfolio.

5. The Bet on AI and Infrastructure: The Most Critical Company in the World

If Microsoft ceased to exist tomorrow, the world would stop. From Excel in global finance to Azure sustaining hospitals and governments, its criticality is absolute. Currently, the company operates more than 400 data centers in 70 regions, adding two gigawatts of new capacity this year alone.

The partnership with OpenAI is the ace up its sleeve. By being the exclusive cloud provider for OpenAI and integrating GPT models across its entire product line, Microsoft has created a nearly insurmountable competitive moat. In my opinion, the market has not yet fully priced in the impact of the AI “Agents” the company is launching, which promise to automate complex processes for Fortune 500 companies, 80% of which already use Azure AI Foundry.

6. Valuation and Strategy: Why I’m Buying Below $450

I do not ignore the fact that a 27.5x P/E ratio is high compared to the S&P 500 historical average. However, we are talking about a company that dominates the future. The recent 20% dip has cleared out the excess euphoria, allowing me to enter at more reasonable prices.

My strategy is clear: I am buying now and will continue to make regular additions whenever the stock trades below $450. I believe MSFT is a “buy for life.” Even if the multiple contracts slightly in the short term due to interest rates, earnings growth will compensate for that compression. Comparing it with other assets, as I discussed in my analysis of the 2025 results of Microsoft, Meta, and Tesla, Microsoft shows the lowest operational volatility of the group.

FAQ – Frequently Asked Questions about Investing in Microsoft (MSFT)

Is it safe to invest in Microsoft with a 27.5x P/E?

Yes, considering the expected growth of 17% and its dominant position in AI. The quality premium justifies the multiple being above the market average.

What is Microsoft’s stake in OpenAI?

Microsoft has invested approximately $13 billion, holding a 49% share of the profits of OpenAI’s commercial entity, in addition to being the exclusive technological partner.

Why is Microsoft considered a critical company?

Because its infrastructure (Azure, Windows, Office 365) sustains the operations of governments, banks, and global corporations. Its failure would cause a systemic digital collapse.

Does Microsoft pay dividends?

Yes, the company has a solid history of increasing dividends, having distributed over $24 billion to its shareholders in 2025.

Conclusion: The Future is Built in Redmond

In summary, my investment thesis for Microsoft is not based on hope, but on numerical facts and the direct observation of its market dominance. We are looking at a company that combines the explosive growth of AI with the safety of a cash-rich balance sheet and massive free cash flow.

I am buying MSFT because I want to own part of the infrastructure that is creating the future. As I mentioned in my article about the Ferrari luxury buying strategy, extreme quality comes at a price, but in the long run, it is the safest investment we can make. I will maintain my discipline of adding below $450, confident that Microsoft will remain the central pillar of my portfolio for years to come. How to Pick Stocks to Buy and Beat the Market

For more official details, you can visit the Microsoft Investor Relations portal.

Disclaimer: This article reflects my personal opinion and does not constitute financial advice. Investing in stocks involves risks of capital loss. Always consult a certified financial advisor before making investment decisions.