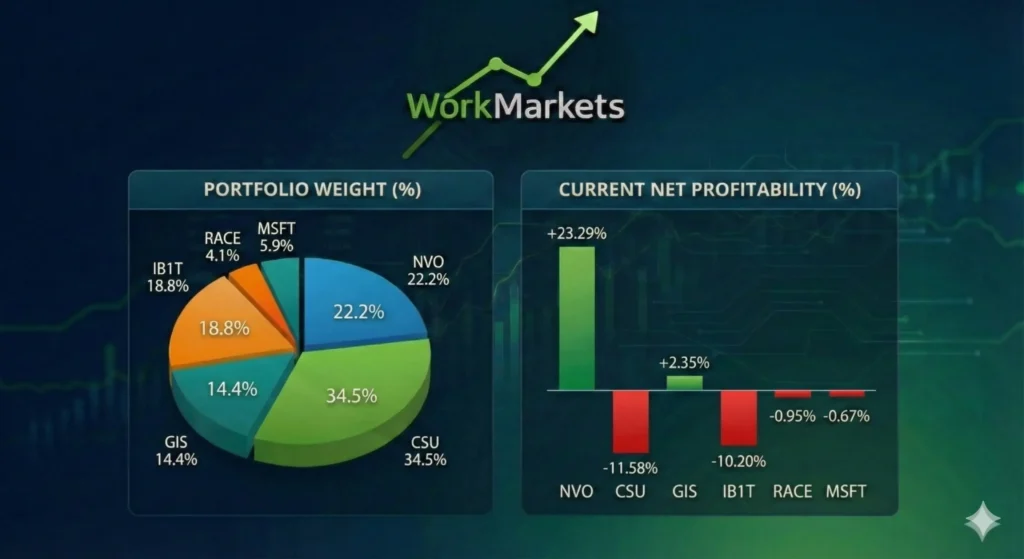

Trading Portfolio February 2026: How My “Skin in the Game” Portfolio Delivered 12.4% While the Market Fluctuated

As of February 2026, the WorkMarketsFinance public portfolio trading reached a total equity of €1,124.76, up from an initial capital of €1,000 in November 2025. Despite a realized profit of €65.54 over the last month, the strategy maintains a planned unrealized P/L (floating loss) of €332.24. This performance demonstrates that margin management and psychological resilience […]