The Dow Jones Industrial Average has breached the historic 50,000-point milestone, closing at 50,115.67 following a massive 1,200-point single-day surge. This rally is underpinned by aggressive deregulation, tariff-driven trade policies, and corporate earnings resilience. Historically, psychological milestones lead to brief consolidation before further expansion. Analysis indicates that corporate productivity remains the premier hedge against systemic currency devaluation in the 2026 economic landscape.

I have always maintained that the financial market is, above all else, a theater of human psychology dressed in the tuxedo of mathematics. Yesterday, we witnessed one of the most staggering acts of this decade: the Dow Jones hitting 50,000. Watching my Bloomberg terminal flash green as the index closed at precisely 50,115.67—an astronomical leap of over 1,200 points in a single session—I couldn’t help but feel we are at a definitive crossroads. The question flooding my inbox today isn’t “why?” but rather “what now?” Are we facing an irrational exuberance preceding an abyss, or is this merely the dawn of a new era of prosperity fueled by disruptive economic policies?

In this article, I invite you to dive into a deep-dive analysis where we peel back the layers of this historic climb, analyze the direct impact of the “Trump Trade,” and explore why index investing remains the master strategy for those seeking financial freedom, regardless of political noise or rampant inflation.

1. The Psychological Weight of 50,000 and the Liquidity “Magnet”

Markets love round numbers. To an institutional algorithmic trader, 50,000 is just another data point; to the retail investor, it is a signal of either validation or intense FOMO. Historically, every time the Dow has breached a ten-thousand-point barrier (10k, 20k, 30k, 40k), we have observed a phenomenon of “attraction and repulsion.”

I contend that this current milestone is fundamentally different. We aren’t just talking about nominal appreciation; we are seeing a direct response to accelerated re-industrialization. When the Dow jumps 1,200 points in one day, it isn’t just pricing in quarterly earnings—it is pricing in a paradigm shift in global economic hegemony.

History as a Compass

Looking back, when the Dow hit 10,000 in 1999, the market spent years consolidating that level due to the Dotcom bubble. However, upon hitting 20,000 in 2017 and 30,000 in 2020, the behavior shifted toward acceleration. The market has grown accustomed to velocity. My technical analysis suggests that 50,000 will now act as a psychological floor. While we may see short-term volatility—the proverbial “kiss of goodbye” to the support level—the structural trend remains unshakable.

2. The Trump Effect: Tariffs, Protectionism, and the Road to 100,000

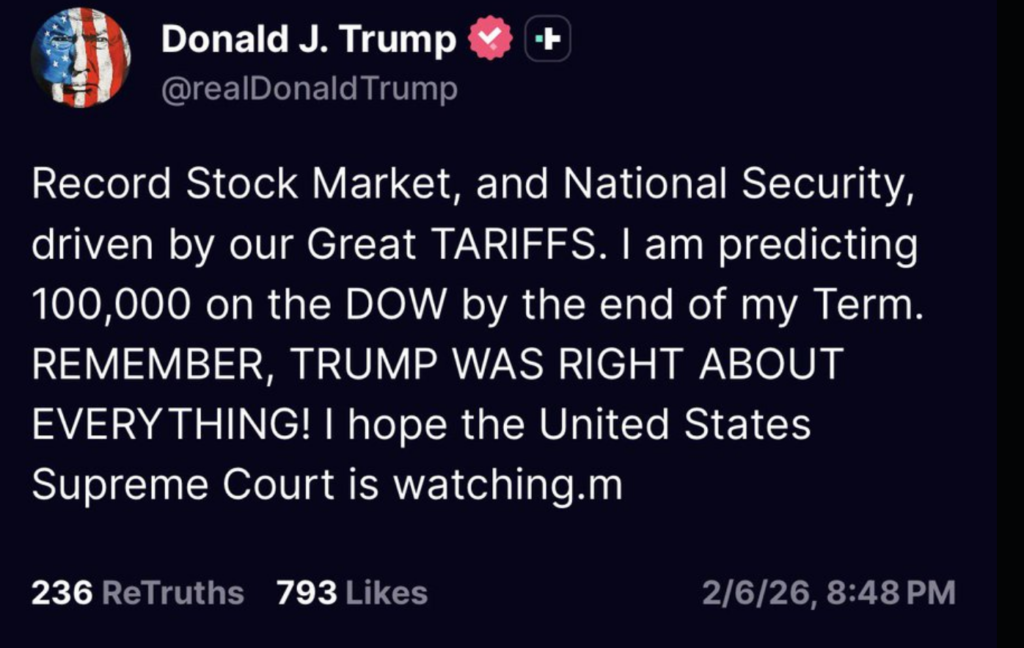

We cannot analyze this record without addressing the “elephant in the room.” Donald J. Trump has already doubled down on his prediction of the Dow hitting 100,000 by the end of his term. To many academics, this figure seems absurd, but for those following the capital flow, the logic is clear: capital flows to where it is protected and incentivized.

The “Great TARIFFS” act as a protective moat for the companies within the index. By increasing the cost of imports, the administration forces internal capital circulation. I observe that this creates a virtuous cycle for the 30 blue-chip giants of the Dow. Companies like Caterpillar, Boeing, and Johnson & Johnson benefit directly from an “America First” industrial policy.

“Record Stock Market… driven by our Great TARIFFS. I am predicting 100,000 on the DOW by the end of my Term.” — Donald J. Trump.

This confidence, though polarizing, injects an optimism that traditional econometric models from the Federal Reserve often fail to capture. If deregulation continues at its current pace, Dow 100,000 ceases to be a “clickbait” prophecy and becomes a mathematical possibility based on earnings multiple expansion.

3. Index Engineering: Why the Long Run is Inevitably Upward

I am frequently asked: “How can you be so sure the market will keep rising in the long term?” The answer doesn’t lie in hope; it lies in the very structural engineering of the index.

The Dow Jones, much like the S&P 500, is a living organism. It has a built-in mechanism for “natural selection.” Companies that fail to maintain relevance, lose market share, or falter in innovation are summarily ejected from the index and replaced by rising powerhouses.

- Survival of the Fittest: By investing in an index, you are buying the “best of the best.”

- Self-Correction: The index eliminates individual bankruptcy risk. If a company goes to zero, it is removed long before it can destroy the index.

- Compounding Productivity: Over the long term, productive enterprises generate real value that outpaces any transitory crisis.

This is why I always emphasize the importance of strategies like Dollar Cost Averaging for financial freedom. By investing consistently, you remove the emotional burden of trying to “time the top” at milestones like 50,000 and focus on the accumulation of quality assets.

4. Historical Comparison: Dow Jones Milestones

To contextualize our current position, I have prepared this table showing the time required for the Dow to conquer each 10,000-point plateau. Notice the exponential acceleration.

| Milestone (Points) | Start Year | Year Achieved | Years Elapsed | Primary Context |

| 10,000 | 1896 | 1999 | 103 years | Digital Revolution / Dotcom |

| 20,000 | 1999 | 2017 | 18 years | Post-2008 Recovery / Low Rates |

| 30,000 | 2017 | 2020 | 3 years | Pandemic Stimulus / Tech Surge |

| 40,000 | 2020 | 2024 | 4 years | Economic Resilience / AI Era |

| 50,000 | 2024 | 2026 | 2 years | Tariff Era / Deregulation |

5. Inflation and Currency Devaluation: The Role of Productive Assets

A point that few mainstream media analysts mention is the silent devaluation of fiat currencies. When we say the Dow hit 50,000, we must ask: did the Dow go up, or did the dollar lose purchasing power?

My view is direct: we are living through an unprecedented period of monetary expansion. In this scenario, holding cash is an invitation to programmed poverty. The companies that comprise the Dow Jones are holders of real assets, patents, and productive capacity. They possess what we call “Pricing Power.”

If raw material costs rise due to inflation, these companies pass those costs to the end consumer, protecting their profit margins. Therefore, the stock market is not just a venue for speculation; it is the ultimate hedge against inflation. Investing in productive companies is, ultimately, converting a currency that the government can print at will into fractions of businesses that produce tangible value for society.

6. Fundamental Analysis: Is the Dow Overvalued?

We are witnessing a productivity revolution driven by Artificial Intelligence and industrial automation, enabling companies to truly do ‘more with less.’ Consequently, I believe we cannot speak of a bubble regarding the Dow Jones as a collective index; rather, we are seeing a legitimate structural value re-rating. However, a dose of pragmatism is required: while the index’s overall trajectory is grounded in growth, certain individual components within the Dow have become undeniably overstretched, trading at ‘expensive’ premiums that are difficult to justify even in this bullish environment.

FAQ: What You Need to Know About Dow 50,000

1. Is it a good time to buy, or should I wait for a correction?

History shows that “waiting for a correction” often results in missing massive rallies. If your horizon is long-term, the current price is just a dot on the chart. A Dollar Cost Averaging (DCA) strategy is consistently superior to attempting to time the market.

2. Is Dow 100,000 a realistic prediction?

Yes, if we consider an average annual growth of 7% to 10% and the continuation of pro-growth fiscal policies and deregulation. It won’t happen tomorrow, but the trajectory is mathematically viable over the next several years.

3. How do Trump’s tariffs affect my portfolio?

Tariffs tend to benefit domestic producers while penalizing companies dependent on complex global supply chains. The Dow, being heavily weighted toward American industrial and tech giants, is uniquely positioned to weather—and benefit from—this environment.

Conclusion: My Vision for the Future

Reaching 50,000 is a victory for economic resilience. I do not see this milestone as a ceiling, but as a new floor. The combination of aggressive economic policy, unprecedented technological advancement, and the index’s natural purging of weak companies creates an environment where pessimism is, historically, a very expensive mistake.

My personal recommendation is clear: do not be paralyzed by the fear of heights. The market climbs a “wall of worry.” As long as there are skeptics shouting “bubble,” there will be fuel for the ascent. Stick to your strategy, focus on productive assets, and remember that, at the end of the day, the market rewards patience and discipline—never fleeting euphoria or momentary panic.

The road to 100,000 has already begun. The question is: will you be on board or watching from the sidelines?

Disclaimer: This article reflects my personal opinion and market analysis. Investing involves risk, and past performance is not a guarantee of future results. Always consult a certified financial advisor before making investment decisions.