In January 2026, my public portfolio focused on consolidating “AI-driven operational efficiency” theses, specifically through an aggressive increase in Constellation Software (CSU), which now represents 34.5% of the total weight. Despite recent volatility in assets like Bitcoin (IB1T) and CSU’s technical correction, new strategic entries into Microsoft (MSFT) and Ferrari (RACE) aim to balance the portfolio between tech hyper-growth and ultra-luxury resilience. The current focus is the “pivot from hype to margins,” favoring companies with dominant cash flows.

1. The January Thesis: “The Age of Implementation”

It’s 2026, and the market has matured. We no longer reward companies just for using AI; we reward those using it to crush overhead and scale vertically. This month’s volatility reflects a market adjusting to “higher-for-longer” interest rates, forcing investors to hunt for Pricing Power.

My macro outlook for this quarter is clear: liquidity is becoming selective. While retail investors panic over short-term drawdowns in high-beta assets like Bitcoin (IB1T), I see a rebalancing opportunity. The focus is on assets that benefit from the cost deflation provided by autonomous software agents.

Finally, the luxury sector—represented by Ferrari—serves as my quality hedge. In a world of geopolitical uncertainty, the ultra-luxury consumer remains decoupled from broader economic headwinds, providing the kind of predictability that the tech sector often lacks.

2. Portfolio Performance & Moves

This month was about “putting your money where your mouth is.” I don’t hide the red; on the contrary, red is where tomorrow’s alpha is built.

Current Allocation & Performance

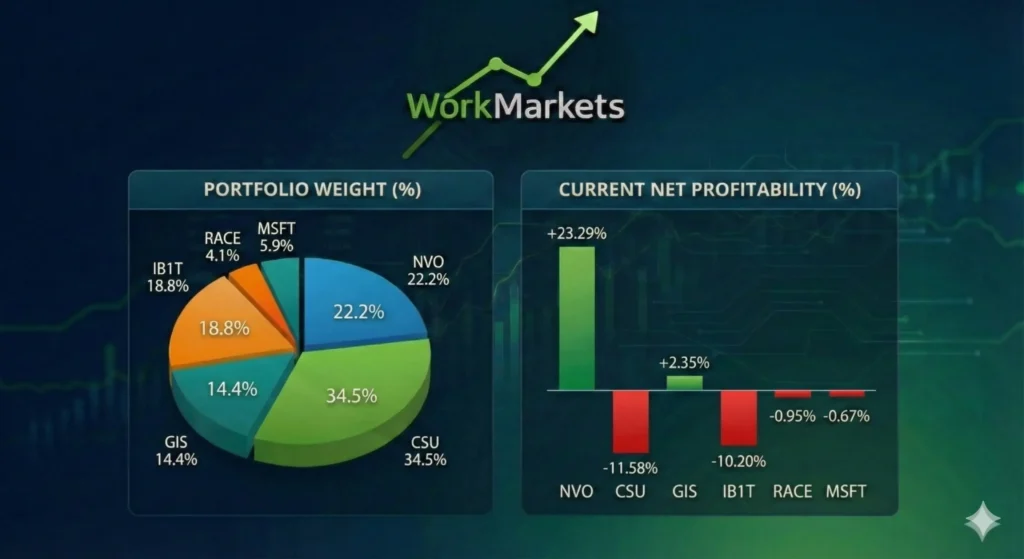

| Ticker | Company Name | Portfolio Weight (%) | Net Profitability (%) |

| CSU | Constellation Software | 34.5% | -11.58% |

| NVO | Novo Nordisk ADR | 22.2% | +23.29% |

| IB1T | Bitcoin ETN | 18.8% | -10.20% |

| GIS | General Mills | 14.4% | +2.35% |

| MSFT | Microsoft | 5.9% | -0.67% |

| RACE | Ferrari | 4.1% | -0.95% |

New Additions: MSFT & RACE

This month, I officially initiated positions in two giants. My entry into Microsoft is based on the unshakable infrastructure they’ve built for the AI economy. Ferrari, on the other hand, is a pure brand equity play with unparalleled margin resilience.

Doubling Down on Constellation Software (CSU)

I have significantly increased my exposure to CSU. Why? Because I believe Constellation is the ultimate “silent winner” of the AI era. Managing hundreds of vertical market software (VMS) companies, CSU has the data and scale to implement automation that slashes OpEx and boosts the efficiency of every business unit. The market is discounting the price today, but I am buying the 2027 margins. Constellation Software Investor Relations (IR)

Currently, the stellar performance of Novo Nordisk (+23.29%) is carrying the portfolio while CSU consolidates.

FAQ – Frequently Asked Questions

1. Why hold Bitcoin (IB1T) through a 10% drop?

Volatility is the price you pay for asymmetry. In 2026, Bitcoin is institutional digital gold; 10% swings are just noise for those with a 5-year horizon.

2. Is a 34.5% concentration in CSU too risky?

It is a high-conviction play. Diversification preserves wealth, but concentration builds it. I trust CSU’s capital allocation track record.

⚠️ Disclaimer

This article represents my personal journey and investment decisions. It does not constitute financial advice. Investing involves risk of loss. Past performance is not indicative of future results.

Join the Community

Want to track my moves in real-time and find out which two companies I’m adding next?

- Join our WhatsApp Group – Macro discussions and article alerts.

- Subscribe to our YouTube Channel – Where I break down these charts in depth every Sunday.

Would you like me to analyze the potential impact of those “two new positions” before I release the full article?