In 2026, the Midterm Elections 2026 landscape is dominated by Kevin Warsh’s nomination to lead the Federal Reserve, signaling an initial hawkish phase that pressures markets in Q1 and Q2. Seasonal volatility and a crash in precious metals are expected to trigger global margin calls. Trump’s strategy focuses on “keeping his powder dry” for aggressive rate cuts and massive fiscal stimulus before November, aiming to reverse the current range-bound bearish trend.

We are entering one of the most complex and fascinating years in recent financial market history. As I write these lines in late January 2026, I feel we are standing before a chessboard where pieces are being moved with surgical precision—precision that is often misunderstood by the masses. The central theme, and the keyword that will dominate every investment discussion this year, is the Midterm Elections 2026. But make no mistake: this is not just another election cycle. It is the culmination of a theory I have been developing, which, with the recent nomination of Kevin Warsh, is beginning to take the shape of an inevitable reality.

I firmly believe that 2026 will be a year of two distinct acts, embedded within a macro choppy-bearish scenario that will test the patience of even the most resilient investors. My vision is clear: President Donald Trump did not choose Warsh by accident, nor is he being “less stimulative” due to a lack of will. On the contrary, he is setting a liquidity trap that will culminate in an explosive move just before the November elections. But until then, the path will be painful, especially for those who ignore the technical signals and the historical seasonality screaming from the charts.

1. The Kevin Warsh Factor and the May Fed Transition

The big news that shook Wall Street in these final days of January was the nomination of Kevin Warsh to replace Jerome Powell, whose term ends in May 2026. Many analysts were left confused. Why choose someone with such an openly hawkish and anti-QE (Quantitative Easing) track record? My thesis is that Trump is playing the “long game.” By placing Warsh in the seat now, he forces a pre-emptive market correction in the first half of the year.

Historically, Warsh is known for criticizing the Fed’s bloated balance sheet and advocating for monetary discipline. The market, anticipating this stance, has already begun “pricing in” a scenario of higher rates for longer and a drastic reduction in liquidity. This is exactly what Trump needs: a market “cleared” of excesses and a Fed with a “stern face” during Q1 and Q2. When Powell finally exits in May, and if the market has already corrected 10% or 15% due to the fear of Warsh’s posture, the new Chair will have the perfect political cover to do the opposite: slash rates aggressively and rapidly under the pretext of “saving the economy” from an imminent recession.

To better understand this central figure, I highly recommend reading my deep dive on who is Kevin Warsh, the new Fed Chair, where I detail his career path and why his apparent rigidity is actually the sacrificial pawn on Trump’s board.

2. The Weight of Approval Ratings: Trump’s 2026 Strategic Dilemma

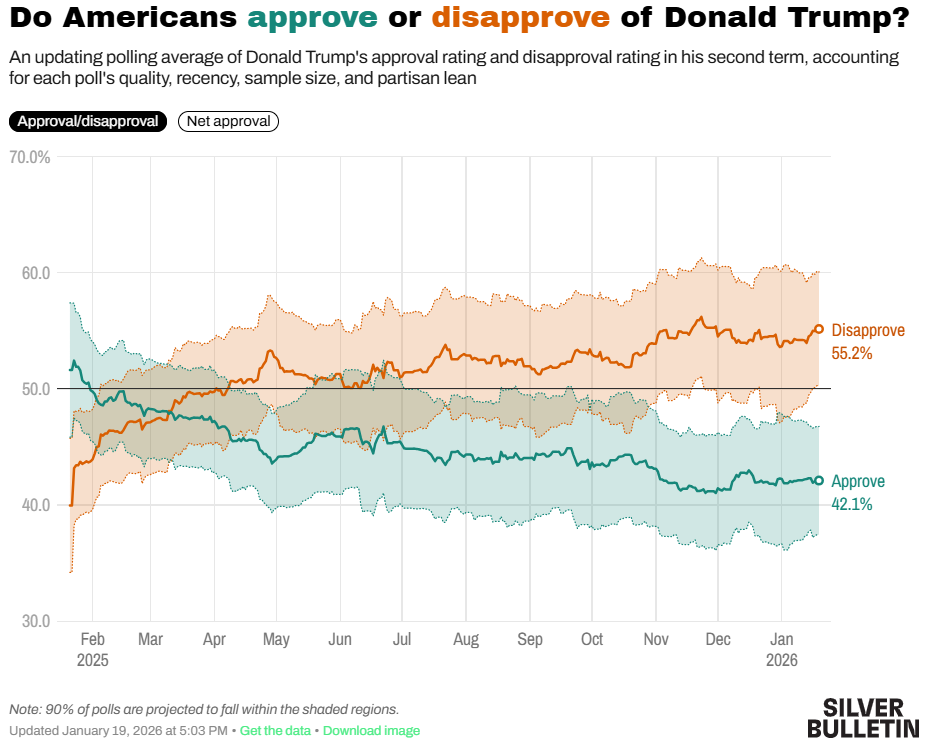

In my fundamental analysis for this cycle, the state of public opinion is a variable that simply cannot be ignored by any serious investor. According to the latest Silver Bulletin polling averages as of late January 2026, Donald Trump’s approval rating stands at 42.1%, while his disapproval rating has climbed to 55.2%. For those of us navigating the markets, this 13-point deficit is more than just a political hurdle; it is the high-octane fuel driving the administration’s sense of economic urgency.

I view this widespread disapproval as the primary catalyst for the “Dry Powder” strategy. Trump is acutely aware that the Midterm Elections 2026 are a battle for his political survival. If he loses control of the House or Senate, the specter of impeachment or total legislative gridlock becomes a mathematical certainty. This political pressure is reflected in the fracturing of consumer sentiment. While the overall Consumer Confidence Index has plummeted to a sobering 84.5, there is a stark partisan divide that traders must account for: Republican confidence remains stubbornly elevated near 120, while Democrats and Independents have cratered toward the 70 mark.

In my view, Trump is strategically allowing the ‘Warsh effect’ to cool the markets and reset expectations now. He knows that an early-year rally would be long forgotten by the time voters head to the booths in November. He needs a “painful” low base in the summer to manufacture a vertical, election-year melt-up that can bridge this approval gap and flip the Independent vote. For the sophisticated investor, the current bearishness shouldn’t be interpreted as a structural failure, but rather as a premeditated political necessity designed to guarantee a late-year recovery.

3. Midterm Elections 2026 Seasonality and the Q1/Q2 Historical Pattern

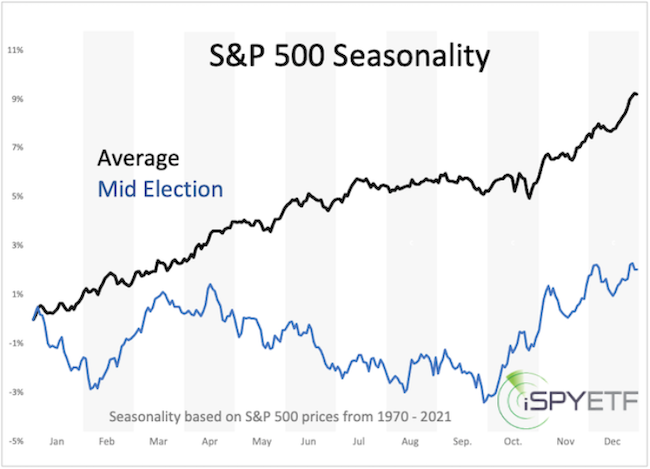

We cannot discuss the Midterm Elections 2026 without looking at the cold data of history. Midterm election years are traditionally the most volatile and challenging for the S&P 500. If we analyze presidential cycles since World War II, the second year of the term (2026, in this case) frequently shows a flat or even negative performance across the first three quarters.

| Election Cycle Period | Avg. Historical Performance (S&P 500) | Avg. Volatility (VIX) | 2026 Trend (Projection) |

| Q1 (January-March) | -1.2% | High | Bearish |

| Q2 (April-June) | +0.8% | Moderate | Range-bound |

| Q3 (July-September) | -2.5% | Very High | Capitulation |

| Q4 (October-December) | +6.4% | Low | Explosive Rally |

Data from S&P Global and recent reports from Goldman Sachs confirm that political uncertainty peaks in the summer of a midterm year. In 2026, with consumer confidence hitting 11-year lows (84.5 points in January), the pessimism is palpable. I view this seasonality chart not as a warning of doom, but as a roadmap. The dip we are seeing now is not the end of the bull market; it is the preparation of the ground. The market needs to “flush out” the retail optimists before the real move begins.

4. The Silver and Gold Crash: The Trigger for Margin Calls

One of the most critical points of my 2026 analysis concerns the precious metals market. Recently, we witnessed a brutal move: silver plunged over 13%, and gold followed suit with a drop of more than 5% in a single trading day following Warsh’s confirmation. This phenomenon is what I call a “safety liquidation.”

When large hedge funds realize that liquidity is going to tighten, they sell what has a profit to cover losses on other fronts. This crash, which I analyzed in detail in the article regarding the Silver Crash and the fall of Gold, is extremely dangerous for the stock market. Why? Because it triggers margin calls. Leveraged investors in tech or crypto, seeing the value of their collateral (gold/silver) collapse, are forced to sell their most liquid positions (S&P 500, Nasdaq) to maintain their margins.

This domino effect is why I foresee a choppy-bearish market for the first half of 2026. This isn’t about bad corporate fundamentals—earnings from Nvidia and Microsoft remain solid—it’s about market mechanics and a lack of dollars in the system.

5. The “Dry Powder” Theory: Trump’s Master Plan for November

Many ask me: “If Trump promised the Dow at 100,000 points, why isn’t he injecting money now?”. The answer is simple: Timing. If he spends his political and economic capital in January, the effect will dissipate long before November. If he loses the Midterm Elections 2026, he faces a very real risk of being removed from office through an impeachment process by a hostile House and Senate. He is fighting for his political survival.

The “Dry Powder” strategy consists of hoarding a series of populist and stimulus measures to launch between August and October. Consider the list of promises currently on “hold”:

- $2,000 Checks: Direct stimulus to consumption that will bypass Congress by utilizing redirected emergency funds.

- Trump Accounts: The plan to give $1,000 to every American child to be invested directly into index funds, creating unprecedented institutional buying pressure.

- Historic Tax Cuts: The extension and expansion of the Tax Cuts and Jobs Act, focused on capital repatriation.

- The Fed Pivot: As I mentioned, the May leadership change allows the “new” Warsh (or a pressured Warsh) to begin a cycle of 50bps cuts per meeting just before the fall.

I believe Trump is letting the market suffer now so he can play the “hero” later. It is a risky move, but it’s the only one that guarantees a landslide victory in November and, consequently, ends the threat of removal.

6. AI, Energy, and the New Industrial Order

Another fundamental pillar of my 2026 vision is the restructuring of the energy sector focused on Artificial Intelligence. The administration has already announced that AI companies will subsidize energy by building their own dedicated power centers. From a fundamentalist standpoint, this is brilliant. We are talking about a symbiosis where Big Tech secures its infrastructure while relieving the national grid, lowering electricity costs for citizens—another key campaign promise.

Recent quotes from the International Energy Agency (IEA) report suggest that energy demand for data centers will triple by 2027. Trump is using this to force a massive deregulation in the nuclear and natural gas sectors. If energy costs drop, inflation (the Fed’s great enemy) collapses, giving Warsh the perfect technical excuse to lower rates. Everything is interconnected.

Frequently Asked Questions (FAQ)

What should we expect from the S&P 500 in the first half of 2026?

Expect a range-bound bearish trend with high volatility, influenced by the transition in Fed leadership and the negative seasonality typical of midterm years leading up to the summer.

Will Kevin Warsh actually lower interest rates?

Despite his hawkish history, my thesis is that Warsh will pivot to aggressive cuts after May 2026, responding to a market correction and political pressure to stimulate the economy before the November elections.

Does the gold and silver crash affect my stock portfolio?

Yes. The abrupt drop in precious metals can trigger margin calls for large funds, forcing them to sell tech stocks and indices to cover losses, which puts downward pressure on the equity market in the short term.

What is the biggest risk for investors in 2026?

The biggest risk is early capitulation. Many investors will sell during the June/July panic, ignoring that the largest rally of the presidential cycle historically occurs immediately following the midterm elections.

Conclusion: My Final Position

To wrap up this analysis, I want to make one thing very clear: do not be fooled by the media noise. 2026 will be a year of nerves of steel. My personal opinion is that we are living through a “controlled technical recession” engineered for political ends. The choppy-bearish market I foresee for the coming months is the opportunity of a lifetime for those who have liquidity.

I am keeping my “dry powder” ready, just like the President. I am watching the support levels on the S&P 500 and waiting for the signal of capitulation that the precious metals crash is giving us. When Kevin Warsh takes the helm in May and the promises of checks and tax cuts begin to take legislative shape, we will see one of the greatest short squeezes in history. Trump’s goal is 100,000 on the Dow; he may not get there in 2026, but the road will be paved with the blood of those who failed to understand this roadmap.

Disclaimer: This analysis reflects my personal opinion and does not constitute financial advice. Markets involve high risks; always consult a professional before making investment decisions.