Nominated by Donald Trump on January 30, 2026, Kevin Warsh is the incoming Chairman of the Federal Reserve. A former Fed Governor (2006–2011) and partner to Stanley Druckenmiller, Warsh brings a blend of Wall Street pragmatism and academic rigor (Stanford/Harvard). His leadership is expected to prioritize market stability and institutional transparency, reinforcing the U.S. Dollar’s status as the world’s primary reserve currency through a commitment to “sound money” and Fed independence.

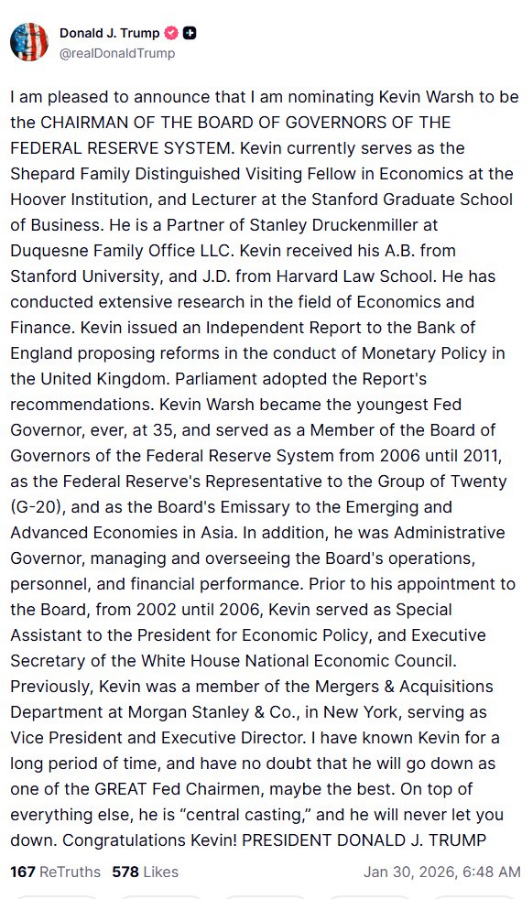

The morning of January 30, 2026, will be etched into the annals of modern financial history as the moment uncertainty regarding the leadership of the world’s most powerful monetary authority was finally put to rest. I watched the official announcement unfold in real-time via President Trump’s social media feed, and while Kevin Warsh’s name had been circulating in the backrooms of Wall Street for months, the confirmation brings a level of technical relief that the market desperately craved. As an analyst who lives by the pulse of the charts and the nuance of FOMC minutes, I view this nomination not just as a political choice, but as a strategic pivot that could define dollar hegemony for the next decade.

The selection of Warsh to succeed Jerome Powell is a move that demands granular analysis. We are not dealing with a pure academic like Ben Bernanke, nor a strictly pragmatic lawyer like Powell. We are dealing with a man who breathes the financial markets, understands the mechanics of capital flows, and, crucially, holds the “seal of approval” from both the conservative wing and the New York financial elite. In this article, I will dissect who Kevin Warsh truly is, his power connections, and why I believe the fears regarding a loss of Fed independence were profoundly overstated.

1. The “Central Casting” Profile: Warsh’s Foundations and Ascent

To understand the man now holding the reins of U.S. monetary policy, we must look at his pedigree. Kevin Warsh is, in Trump’s own words, the embodiment of someone from “central casting.” Educated at Stanford University with a J.D. from Harvard Law School, Warsh combines legal precision with a classic liberal economic outlook.

His career began at the epicenter of global capitalism: Morgan Stanley. During his seven-year tenure in the Mergers & Acquisitions (M&A) department, eventually rising to Executive Director, Warsh gained a perspective that few central bankers possess. I consider this background vital; he views interest rates not merely as a variable in an econometric model, but as a real-world cost that dictates corporate investment and risk-taking. He understands “the plumbing” of the financial system.

The Intersection of Political and Economic Power

Before his first stint at the Fed in 2006, Warsh served as Special Assistant to the President for Economic Policy at the White House National Economic Council (2002–2006). It was here that he honed his diplomatic skills and built a formidable network. More recently, his role as a partner to Stanley Druckenmiller at Duquesne Family Office LLC elevated his status to “market royalty.” Druckenmiller is a living legend in the macro-investing world, and Warsh’s proximity to him grants him instant credibility with hedge fund titans and institutional managers.

2. The Youngest Governor in Federal Reserve History

Many younger investors may not recall that Kevin Warsh made history by becoming the youngest person ever appointed to the Fed’s Board of Governors at age 35. He served from 2006 to 2011—a period that spanned the depths of the Global Financial Crisis (GFC).

My technical assessment of this period is clear: Warsh acted as the vital liaison between the Fed and Wall Street as the system neared collapse. He was the Fed’s emissary to the G-20 and emerging Asian economies. This “in-the-trenches” experience is what makes him uniquely qualified for the challenges of 2026, a world where inflation remains a specter and geopolitical tensions threaten global supply chains.

Comparative Analysis of Fed Leadership

| Characteristic | Kevin Warsh (2026 Nominee) | Jerome Powell (Predecessor) | Ben Bernanke (GFC Era) |

| Primary Background | Wall Street / Macro Investing | Private Equity / Legal | Academia (PhD Economics) |

| Age at Nomination | 55 years old | 65 years old | 52 years old |

| Monetary Stance | Moderate Hawk / Reformist | Pragmatic / Data-dependent | Dove / Expansionist |

| Geopolitical Focus | Asia & Currency Reform | Domestic Stability | Deflation Combat |

3. Reforming Monetary Policy: The Bank of England Report

One of the most compelling aspects of Warsh is his critical mind. He is no defender of the status quo. Evidence of this can be found in his independent report for the Bank of England (BoE), where he proposed deep reforms to the conduct of monetary policy in the UK.

The fact that the British Parliament adopted his recommendations proves that Warsh possesses a vision for transparency and efficacy that transcends American borders. He argues that central banks must be clearer in their communication and less reliant on mathematical models that failed to predict the post-pandemic inflationary spike. I expect we will see a much more direct Fed under his command, reducing the “interpretive noise” that so often triggers unnecessary market volatility.

4. “Central Casting” and the Fed’s Independence

The dominant media narrative over the last few months was the fear that Trump would appoint a “puppet” to artificially suppress interest rates. However, by choosing Kevin Warsh, Trump has arguably done the opposite. Warsh is known as a hawk—someone who does not hesitate to maintain higher rates to protect the currency’s value.

From my perspective, Warsh is the ultimate guarantee of Fed autonomy. Why? Because he is too highly respected by his peers and the markets to submit to political pressures that would tarnish his historical legacy. He understands that Fed credibility is the United States’ most valuable intangible asset. If that credibility erodes, the dollar fails. As a former partner to Druckenmiller, he knows that a debased dollar is the recipe for imperial decline.

5. Fundamental Analysis: The Case for a Stronger DXY

Let’s move to the core of my thesis for 2026. For years, we’ve heard the “de-dollarization” drumbeat and predictions of the dollar’s demise as the reserve currency. However, with Kevin Warsh at the helm of the Fed, I anticipate the opposite.

- Capital Attraction: A Warsh-led Fed is likely to favor “sound money” policies. This naturally attracts foreign capital seeking safe yields and currency appreciation.

- Institutional Confidence: Capital markets breathe easier with an M&A and crisis specialist in charge. Treasury volatility tends to subside when the “driver” understands market mechanics.

- Rate Differentials: While the ECB and other central banks struggle with anemic growth, Warsh’s Fed may maintain positive real rates that support the DXY Index.

I contend that in a scenario of global uncertainty, Warsh’s pragmatism will serve as a liquidity magnet for U.S. assets.

FAQ: Key Questions on Kevin Warsh and the Fed

Who is Kevin Warsh and why was he chosen?

Kevin Warsh is an economist, jurist, and former Fed Governor. He was chosen by Donald Trump due to his extensive market experience, his role in managing the 2008 crisis, and his reformist vision for monetary policy. He is viewed as a bridge between the administration and Wall Street.

What is Warsh’s stance on interest rates?

Historically, Warsh leans hawkish. He prioritizes price stability and a strong currency. While he is pragmatic, he generally believes the Fed should avoid over-intervention in market mechanisms and keep inflation strictly in check.

Will the Fed lose its independence under Warsh?

Market analysis suggests no. Warsh’s professional stature and his past record of criticizing government overreach suggest he will be a staunch defender of the Fed’s institutional autonomy, focusing on long-term economic stability over short-term political gains.

Conclusion: The Redemption of Autonomy and the Dollar’s Trump Card

In analyzing the full scope of this nomination, my conclusion is that we are at a positive and perhaps unexpected turning point. For months, pessimistic analysts (myself included, during periods of peak political noise) feared the Fed would become an executive branch “rubber stamp.” Today, I can state with confidence that those fears have not materialized.

The nomination of Kevin Warsh is a victory for modern economic orthodoxy. He possesses the rare ability to speak the language of politicians without sacrificing the principles of the market economy. His leadership will preserve the credibility of an independent Fed, as much as is possible in a polarized era, and that is the very oxygen the global financial system requires.

Most importantly for your portfolio: this choice may very well strengthen the dollar just as the world is betting on its fall. While many proclaim the end of USD hegemony, a Warsh-led Fed signals that the dollar will remain the ultimate safe haven. The dollar is not going to relinquish its status; instead, under Warsh’s baton, it will reaffirm itself as the only asset capable of providing liquidity and security in an era of global transformation.

For investors, the signal is clear: technical competence has returned to the top of the monetary pyramid. And that, in itself, is the best long-term indicator we could receive.

Furthermore, I cannot ignore the technological frontier that Kevin Warsh seems poised to embrace. The modernization of the financial architecture through dollar tokenization in the US is no longer a futuristic concept but a strategic necessity. By integrating blockchain for wholesale transactions and clearing, the Fed can eliminate traditional frictions, ensuring that the dollar remains not only the most trusted currency but also the most efficient in a digital-first global economy.

For more in-depth analysis on monetary policy and macro strategies, follow official data at the Federal Reserve.