As of 2026, Constellation Software Inc. (CSU) stands as the premier Vertical Market Software (VMS) consolidator. Unlike horizontal giants like Adobe or Salesforce, CSU focuses on mission-critical niches with high switching costs and low churn. With a historical ROIC exceeding 20% and a disciplined, decentralized M&A engine, CSU thrives in a high-interest, AI-driven environment. This analysis explains why I prioritize CSU over horizontal software, utilizing a fractional allocation strategy to capitalize on market volatility.

In my journey through the global financial markets, I have learned that true wealth is built not by chasing the latest trend, but by concentrating capital into high-conviction, high-quality assets. As we navigate the complexities of 2026, the technology sector has reached a critical tipping point. We are witnessing a clear divergence: the erosion of the “Horizontal Software” moat and the absolute dominance of “Vertical Market Software.” I want to be categorical: I have zero interest in holding Adobe, Salesforce, or NICE in my portfolio. This isn’t a speculative hunch; it is a technical decision based on the structural fragility of their business models in the age of mature Generative AI. For me, the only company that justifies patient, long-term capital in this space is Constellation Software (CSU). This article serves as a direct continuation of my thesis presented in Constellation Software: A Unique Opportunity, where I first outlined why specialization is the ultimate competitive advantage.

1. The Horizontal Trap: Why I Avoid Adobe and Salesforce

Many investors remain tethered to the outdated notion that “Large Cap” equals “Safe Haven.” However, in 2026, the sheer scale of companies like Adobe and Salesforce has become their greatest liability. These are Horizontal Software firms—their tools are designed to be used by everyone, across every industry. While this allowed for massive scaling in the 2010s, it now represents a critical vulnerability.

The commoditization of Generative AI has lowered the barriers to entry for productivity tools. Today, agile startups can integrate Large Language Models (LLMs) to replicate core CRM or creative features at a fraction of the cost. I choose not to buy these companies because their customer acquisition and retention costs have reached unsustainable levels. Horizontal giants are trapped in a permanent “R&D arms race.” If they stop innovating for a single quarter, they risk being replaced by a cheaper, AI-native alternative. Adobe must constantly prove its ecosystem’s worth, whereas Constellation Software operates in “invisible” niches where the competition is practically non-existent.

2. The Unassailable Moat of Vertical Market Software (VMS)

The technical core of my thesis lies in the nature of the customer relationship. Constellation Software does not provide “optional” productivity tools; it provides the mission-critical operating systems for specific industries. Whether it is managing municipal water treatment plants, public library systems, or specialized maritime logistics, CSU’s software is the “central nervous system” of the client’s operation.

The “Moat” of CSU is built on extreme switching costs. Replacing a VMS solution isn’t just a matter of moving files; it involves retraining entire workforces and re-engineering deep-seated operational workflows. Consequently, CSU’s churn rates remain remarkably low, often below 5%. Furthermore, CSU’s decentralized M&A engine is a masterpiece of capital allocation. Instead of making multi-billion dollar “bet-the-company” acquisitions like Salesforce’s purchase of Slack, CSU acquires hundreds of small VMS firms at disciplined multiples. In 2026, this “Berkshire Hathaway of Software” model has proven superior because it diversifies risk across thousands of small, profitable domains.

| Technical Comparison (2026 Projections) | Constellation Software (CSU) | Horizontal Software (Adobe/CRM Avg) |

| Return on Invested Capital (ROIC) | > 20\% | 12\% – 15\% |

| Sales & Marketing Spend | < 10\% of Revenue | 30\% – 45\% of Revenue |

| Switching Costs | Extremely High (Systemic) | Moderate (Feature-dependent) |

| M&A Strategy | High-Volume, Low-Ticket | Low-Volume, “Mega-Deals” |

| AI Disruption Risk | Low (Niche Data Moat) | High (Commoditization of code) |

3. AI as a Margin Expansion Catalyst

There is a prevailing myth that AI will replace all software. In reality, while AI is a threat to horizontal generalists, it is a massive tailwind for vertical specialists. For Constellation Software, Generative AI is not a competitor—it is an internal efficiency engine.

I view AI as a silent catalyst for CSU’s EBITDA margins. CSU’s vast portfolio includes many “legacy” systems that require ongoing maintenance. With the advanced AI-assisted coding tools available in 2026, CSU can drastically reduce the cost of maintaining and patching these systems. They can automate 30% of technical support and 40% of routine coding tasks across their 800+ business units. The customer continues to pay the same recurring subscription fee because the software is indispensable, but CSU’s cost to deliver that service drops significantly. This is the difference between being a slave to innovation (Adobe) and a master of efficiency (CSU).

4. My Allocation Strategy: The Power of “Scaling In”

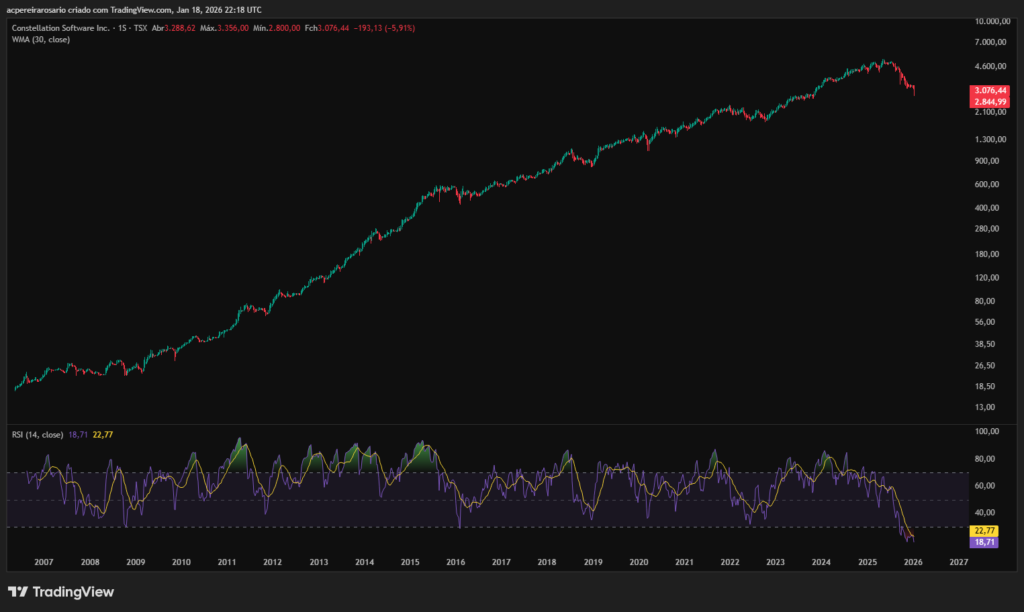

A common mistake I see among retail investors is the “all-in” mentality. My approach to Constellation Software is governed by clinical discipline. I do not enter a position with my full intended capital at a single price point. Instead, I utilize fractional allocations (scaling in) as the price action develops.

I will be honest: I would love to see CSU trade at 2,000 CAD again. While the current price reflects its elite status, a correction toward that level would be a “generational” opportunity to aggressively increase my exposure. If the price drops, I do not feel panic; I feel opportunity. Buying an exceptional business at a discount is the ultimate goal of fundamental analysis. By scaling in, I ensure that my cost-basis remains optimized while participating in the long-term compounding of the business. My thesis doesn’t change if the stock drops 20%; in fact, it strengthens, because the underlying cash flows of the VMS units remain unaffected by market sentiment.

FAQ – Frequently Asked Questions for Investors

Why not hold Adobe or Salesforce for the sake of diversification?

Diversification into assets facing structural headwinds is simply “di-worse-ification.” In 2026, the risk premium for horizontal software does not justify the potential downside as AI commoditizes their core features. I prefer concentration in excellence.

Can AI-native startups disrupt CSU’s niche markets?

It is highly unlikely. AI startups lack the decades of proprietary industry data and the deep integration into client workflows that CSU possesses. VMS is as much about “process knowledge” as it is about “code.”

How does CSU handle rising interest rates in 2026?

CSU is one of the few tech companies that funds its acquisitions primarily through internal cash flow rather than external debt. This makes them “anti-fragile” in a restrictive monetary environment, as they can acquire distressed competitors while others are sidelined.

Conclusion: The Discipline of Conviction

Investing in Constellation Software in 2026 is an exercise in recognizing the power of the “unseen” market. While the headlines are dominated by Silicon Valley’s horizontal giants, the real compounding is happening in the specialized niches of VMS. I refuse to follow the herd into overcrowded and vulnerable trades.

My strategy remains unchanged: I will continue to build my position in CSU through disciplined, incremental allocations, always ready to strike harder if the market offers a gift near the 2,000 CAD mark. For those who wish to verify the fundamentals, I highly recommend studying the company’s official filings and Mark Leonard’s shareholder letters on the Constellation Software Inc. official website.

Disclaimer: This article reflects my personal opinion and investment strategy for 2026. It does not constitute personalized financial advice. Investing in equities involves risk. I hold a long position in Constellation Software (CSU) at the time of writing and do not hold positions in Adobe, Salesforce, or NICE.