In 2026, the global pension crisis has reached a tipping point, driven by an irreversible demographic inversion and the insolvency of traditional “pay-as-you-go” systems. While AI and robotics have boosted corporate productivity, they have failed to bridge the Social Security deficit due to capital mobility and shifting tax bases. For the modern investor, technical analysis of sovereign debt confirms that relying on state-funded retirement is a systemic risk. The only viable path to solvency is aggressive private capital accumulation and long-term equity compounding.

I have spent the better part of the last decade warning my readers about the structural rot at the heart of the Western social contract. Today, in January 2026, we are no longer discussing a theoretical “Social Security cliff”—we are living through the initial tremors of its collapse. As a senior analyst, I’ve watched as politicians from Washington to Brussels kicked the proverbial can down the road until the road simply ended. The pension crisis is not merely a budgetary oversight; it is a mathematical certainty that has finally come due. If you are banking on a state pension to fund your golden years, you aren’t just an optimist; you are ignoring the most fundamental laws of economics.

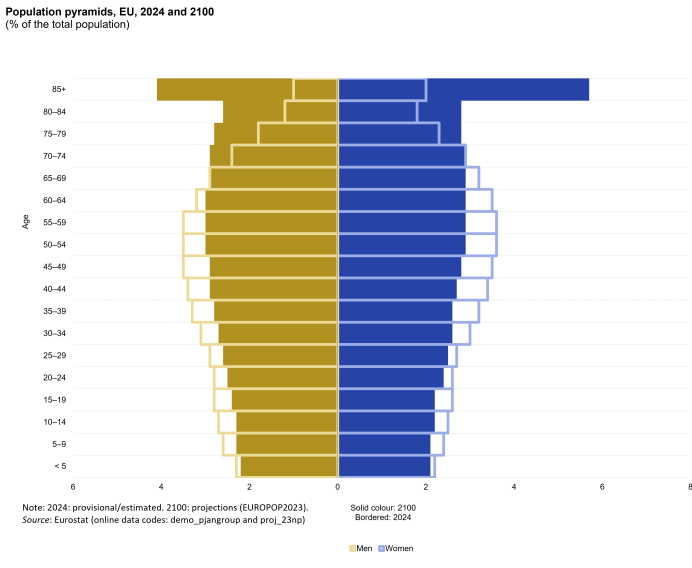

The global financial landscape in 2026 is defined by a brutal reality: the demographic pyramid has not just narrowed—it has inverted. We are witnessing a historic transfer of burden onto a shrinking workforce that can no longer sustain the “pay-as-you-go” models established in the mid-20th century. In this deep-dive analysis, I will strip away the political platitudes and show you why technology, while transformative, is not the “get out of jail free” card the government hopes it is. More importantly, I will outline the only strategy that ensures you don’t spend your final years in state-sponsored poverty.

1. The Arithmetic of Failure: Demographics vs. The State

The fundamental flaw of almost every public retirement system is its reliance on a perpetual growth of contributors. In the United States, the Social Security Trust Fund—which for decades was a symbol of stability—is now, in 2026, facing imminent exhaustion far sooner than the pre-pandemic 2033 estimates. Why? Because the old-age dependency ratio has hit a catastrophic level. We now have fewer than 2.1 workers for every one retiree in several developed economies.

I firmly believe that the “contract between generations” has been unilaterally broken. We are asking a generation of young workers, already burdened by 2026’s high cost of living and housing scarcity, to fund the retirements of a cohort that is living 20 to 30 years longer than the system’s architects ever envisioned. This is not just a fiscal deficit; it is a social powder keg. According to the OECD, the fiscal gap required to maintain current benefit levels would necessitate a tax hike so severe it would trigger a permanent capital flight to more competitive jurisdictions.

From a fundamental analysis perspective, the liability of unfunded pension mandates is the “grey swan” of 2026. It is a known risk that is being ignored because the solution—slashing benefits or raising the retirement age to 72—is political suicide. As an investor, you must treat these state promises as a “zero-value” asset in your personal balance sheet.

2. AI and Robotics: The Productivity Paradox

There is a popular narrative circulating in 2026 that Artificial Intelligence (AI) and robotics will provide a magical windfall to save the social safety net. The logic suggests that as robots replace human workers, the resulting explosion in GDP and productivity can be taxed to fund the pension crisis deficit. While I am a bull on AI’s impact on corporate margins, I am a bear on its ability to save the public pension system.

The primary issue is the Labor Share of Income. As AI automates high-value cognitive and manual tasks, wealth is increasingly concentrated in the hands of the owners of capital—the 1% who own the algorithms and the hardware. Governments are desperately trying to implement a “Robot Tax,” but as I have often argued, capital is cowardly. If the US or the EU taxes automation too heavily, that “intelligence” will simply migrate to low-tax havens or decentralized clouds.

Furthermore, the IMF has highlighted in its 2026 Global Stability Report that while AI increases productivity, it does not necessarily increase the taxable wage base. If machines do the work, there are no payroll taxes. Unless the government nationalizes the means of AI production—a move that would destroy innovation—the “Robot Tax” will remain a bureaucratic fantasy. My position is clear: AI will make the world richer, but it will make the State poorer by eroding the traditional tax base.

Comparative Sustainability Matrix (2026 Projections)

| Model Type | Demographic Resilience | Risk of Default | Individual Control |

| Social Security (Pay-as-you-go) | Very Low | Extreme | None |

| Corporate Pension (Defined Benefit) | Low | High | Minimal |

| Robotics-Funded State Tax | Uncertain | Very High | None |

| Private Equity/401(k) Model | High | Low (Market Dependent) | Total |

3. The 2026 Sovereign Debt Trap: Why Inflation is the Only Way Out

Governments in 2026 are faced with an impossible choice: default on their promises to seniors or devalue their currency. I am betting on the latter. Since a hard default is politically impossible, central banks and treasuries are engaging in “financial repression.” By keeping interest rates below the real rate of inflation, they are slowly eroding the value of the debt—and, by extension, the purchasing power of your future pension.

This is why the pension crisis is essentially an inflation crisis. Even if you receive your promised $3,000 a month in 2035, if a gallon of milk costs $25, the government has fulfilled its promise on paper while failing you in reality. As a senior analyst, I advise you to look at the technical analysis of the US Dollar Index (DXY) and the rise of hard assets. The only way to hedge against a state that is incentivized to debase its currency is to own assets that the government cannot print.

4. The Solution: Building Your Own Fortress

If the state cannot save you, and technology will only benefit the owners of capital, the conclusion is inescapable: you must become an owner of capital. The only solution to the pension crisis is the total privatization of your own retirement through aggressive saving and intelligent investing.

We must look to the masters of long-term wealth for a blueprint. I often cite the incredible story of Ronald Read, the gas station attendant who amassed an $8 million fortune. He didn’t have a high salary, and he didn’t have a government bailout; he had time, discipline, and a deep understanding of the stock market. You should read more about the Ronald Read stock picking strategy to understand how consistent, dividend-focused investing can outperform any state-run scheme.

In 2026, your portfolio must be your “private Social Security.” This means:

- Maxing out tax-advantaged accounts: 401(k)s and IRAs are your primary defense.

- Focusing on “Quality” and “Value”: In a high-inflation, low-growth 2026 environment, companies with strong pricing power and low debt are king.

- Direct Exposure to AI Leaders: If the robots are taking the jobs, you must own the companies that own the robots. This isn’t speculation; it’s a fundamental hedge.

FAQ – Frequently Asked Questions on the Retirement Crisis

Is Social Security going to go bankrupt in 2026?

No, it won’t “go bankrupt” in the sense of disappearing, but it is reaching a point where benefits may be automatically slashed by 20% to 25% if the trust fund is depleted and no legislative action is taken.

Can a “Robot Tax” really work?

Technically, yes, but practically, it is a nightmare. It encourages companies to move operations offshore, potentially leading to a “race to the bottom” in corporate tax rates among nations competing for AI infrastructure.

Why is Ronald Read’s strategy relevant in 2026?

Because his strategy relied on compound interest and dividend reinvestment, which are the only forces powerful enough to outpace the currency debasement that governments use to manage their pension debt.

Should I still count on my state pension in my retirement planning?

My professional advice is to count it as zero. If you receive it, consider it a bonus. Your primary plan must be entirely self-funded to ensure security.

Conclusion: The Era of Individual Responsibility

The year 2026 marks the definitive end of the “Nanny State” era of retirement. The pension crisis is a symptom of a larger shift in the global economy—a transition from a labor-based society to a capital-based one. My position is unyielding: the only person who can guarantee your future is the person looking back at you in the mirror.

While the rise of AI and robotics offers a glimpse into a high-productivity future, that wealth will not be distributed by the benevolence of the state. It will be claimed by those who have the foresight to invest today. Do not be a victim of a system that was designed for a world that no longer exists. Learn the lessons of the past, embrace the volatility of the present, and build your own fortress.