In this January 2026 transparency report, my public trading portfolio shows an 11.8% equity growth since November 2025, rising from €1,000 to €1,118.02. Despite realizing €17.82 in gains this week through tactical swing executions, I maintain a high-conviction Bullish thesis on the U.S. Dollar Index (DXY), currently weathering a floating drawdown of -€119.45. This report breaks down the macro logic behind my short positions on EURUSD and GBPUSD and explains why the technical support at the 99.000 level confirms my “King Dollar” outlook in an AI-driven global economy.

1. The Monthly Thesis: The Dollar Paradox of 2026

The 2026 market does not forgive hesitation. While the European Central Bank struggles with technological stagnation across the Eurozone, the U.S. continues to attract massive capital inflows driven by its leadership in supercomputing infrastructure and modular nuclear energy. My thesis is straightforward: the growth divergence between the U.S. and the rest of the G7 is reaching a breaking point, favoring long-term USD appreciation.

Many analysts are puzzled by the Greenback’s resilience, but I’ve detailed the mathematical logic behind this phenomenon in my recent deep dive: The Dollar Paradox of 2026: Why Falling Rates Will Skyrocket the DXY and How I’m Positioned. Essentially, we are witnessing a “flight to quality” that transcends traditional interest rate differentials.

We are seeing a scenario where global liquidity is being drained into American assets. The DXY (Dollar Index) chart shows critical support in the 98.000-99.000 zone. My conviction is that this technical “floor” will force interest rates to remain “higher for longer” than the bond market currently anticipates, further fueling the currency’s ascent.

2. Trading Section: Performance & Reality Check

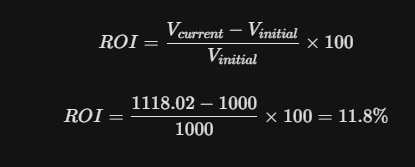

The portfolio started with €1,000 on November 10, 2025. Today, the cash balance stands at €1,118.02.

Portfolio ROI

The total return on initial capital is calculated as follows:

Closed Trades (Week of Jan 11 – Jan 16)

This week was focused on tactical swing closures to lock in realized gains while waiting for the core long-term positions to mature.

| Asset | Type | P/L (EUR) | Status |

| EURUSD | Short | +€5.26 | Closed |

| USDCHF | Long | +€5.16 | Closed |

| GBPUSD | Short | +€7.40 | Closed |

| Weekly Total | +€17.82 |

Open Positions (Skin in the Game)

In the spirit of radical transparency: I am currently carrying a negative floating P/L of -€119.45. This is primarily driven by short positions on GBPUSD (my heaviest exposure at -€61.86) and AUDUSD. My current Margin Level of 266.48% is healthy, allowing me to absorb market noise while waiting for the DXY to resume its bullish trajectory. Being “Short” against the Euro, Pound, and Aussie Dollar validates my ultra-bullish stance on the USD.

3. “Chart of the Month”: DXY at Weekly Support

The U.S. Dollar Index (DXY) chart is the anchor of my entire strategy.

Technical Setup: The DXY is currently testing a long-term ascending trendline (marked in red). The RSI (14) is at 51.13, indicating plenty of “runway” before reaching overbought conditions. The green zone on the chart (current level 99.181) represents a major institutional accumulation base. As long as price holds above this support, I will continue to fade rallies in pairs like EURUSD and GBPUSD.

Meanwhile, EURUSD is failing to break out of its descending channel, confirming that the Euro remains the “weak link” in this 2026 geopolitical equation.

4. Join the Community

Trading in 2026 requires real-time data and a “stomach of steel.” If you want to track the recovery of this drawdown and see how I manage capital in real-time:

- WhatsApp: Get market sentiment alerts and my daily trading journal. Join the Community

- YouTube: Deep technical analysis and live trading every Sunday at 9 PM GMT. Subscribe to WorkMarketsFinance

5. FAQ

1. Why hold negative trades open? In institutional swing trading, drawdown is a natural part of a winning position’s lifecycle. My macro thesis for the Dollar is long-term; closing now would mean ignoring the technical support analysis.

2. Is there a risk of a Margin Call? No. My risk management uses the Margin Level (266%) as a tactical stop. With €623.84 in available funds, the account is well-buffered to ride out the volatility.

3. What is your win rate? Win rate is a vanity metric; Risk/Reward is what pays the bills. While we closed 100% of our tactical trades in profit this week, the focus remains on the average gain per winning trade vs. losers.

Disclaimer: This content is for informational and educational purposes only. Financial investing involves high risk. Past performance is not indicative of future results. The author holds the positions mentioned in this article (Skin in the Game).