In January 2026, the CNN Fear & Greed Index (66 – Greed) and the AAII Sentiment Survey (49.5% Bullish) have reached levels of extreme euphoria, while global investor cash allocation has plummeted to historic lows (below 30%). This asymmetry suggests an “overextended” and vulnerable market. The massification of ETFs and the absence of liquidity to “buy the dip” create a high risk of a snowball effect, justifying a defensive stance and a long VIX position.

It is mid-January 2026, and as I survey the current landscape of the financial markets, I feel a sense of unease that I haven’t experienced in a long time. The exuberance permeating Wall Street and major European exchanges seems to ignore a fundamental law of financial physics: when everyone is already seated at the table, there is no one left to buy the next round. This article is not merely a technical analysis; it is a warning about the fragility hidden behind seemingly robust numbers. I will dissect the sentiment indicators from CNN and AAII, and explain why the current lack of liquidity in investors’ hands is the dry powder that could trigger a violent correction.

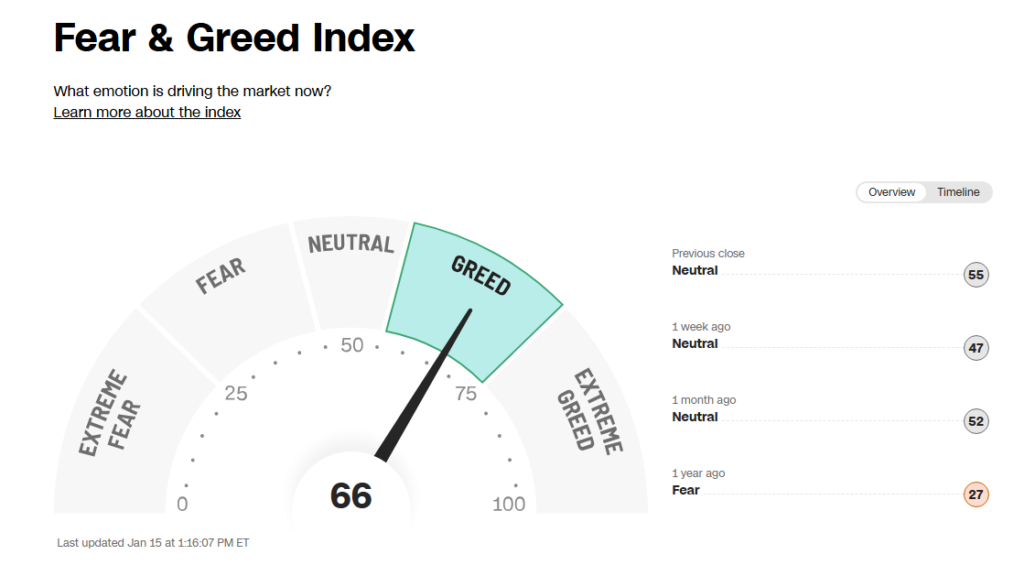

1. The Greed Thermometer: Deconstructing the CNN Fear & Greed Index

I have been monitoring the CNN Fear & Greed Index daily for years. Today, the needle points to 66, placing us firmly in Greed territory. For those unfamiliar, this index is a “meta-indicator” that aggregates seven different factors, ranging from market momentum to safe-haven demand. What concerns me today is not just the absolute number, but the sheer speed at which we transitioned from fear to greed in such a short window.

The utility of this indicator lies in its ability to measure the emotional temperature of both institutional and retail investors. When the index enters Extreme Greed territory, it becomes one of the best contrarian indicators I know. The market is a machine for transferring wealth from the impatient to the patient, and extreme greed is the classic signal that risk is being severely underestimated.

The components of the index, such as the Put/Call ratio and market volatility, show that investors are paying incredibly low premiums for protection. There is an almost religious belief that central banks (the Fed and the ECB) will intervene at the first sign of a downturn. However, history teaches us that market asymmetry is cruel: the ascent is by the stairs, but the descent is by the elevator. When sentiment is at this level, any geopolitical spark or slightly negative macroeconomic data point can trigger a disproportionate retracement.

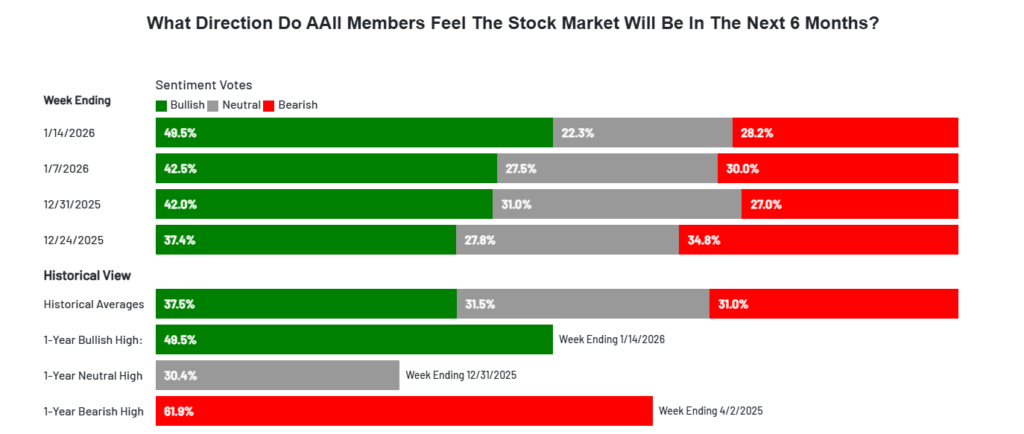

2. The Voice of Retail: Unprecedented Euphoria in the AAII

While the CNN index gives us the general “climate,” the AAII Sentiment Survey (American Association of Individual Investors) provides a direct pulse of the retail investor. The data from January 14, 2026, is, in my view, terrifying. We have 49.5% Bullish investors, the highest level in the past year. Simultaneously, Bearish sentiment has dropped to residual levels.

I use the AAII as a pure contrarian tool. Historically, when AAII member optimism exceeds the 45-50% threshold, we are dangerously close to a local or cyclical top. Why? Because the individual investor is typically the last one to join the party. When your neighbor and the person at the local coffee shop start giving you stock tips, the smart money is already looking for the exit.

This euphoria reflects a short memory. Investors have forgotten the drawdowns of 2022 and 2023 and are now focused solely on FOMO (Fear Of Missing Out). The problem with having nearly 50% bulls is that future demand is being cannibalized. If everyone believes the market will go up and has already bought their positions, who are the marginal buyers who will push prices to new highs? The answer is: almost no one.

3. The Hidden Danger: Cash Allocation at Historic Lows

This is perhaps the most critical point of my current analysis. J.P. Morgan data shows a stark reality: implied cash allocation by global non-bank investors has dropped to approximately 30%. This value is significantly lower than the post-Lehman average and is dangerously approaching levels seen before major historical corrections.

What happens when investors hold very little cash? The answer is a lack of support in the event of a crash. In a healthy market, when stocks drop 5% or 10%, investors use their cash to “buy the dip,” which stabilizes prices. However, in 2026, we are in a situation where portfolios are “fully invested.”

If a correction occurs, there will be no fresh capital to enter. On the contrary, if investors need liquidity or panic, they will be forced to sell. Since there are no active buyers with cash reserves, prices must drop much further to attract any interest. This can generate a snowball effect or a flash crash where supply massively outweighs available demand.

4. The Massification of ETFs and the Risk of “Weak Hands”

We cannot discuss the 2026 market without mentioning the hegemony of passive ETFs. Passive management has democratized investing, which is positive, but it has created a correlation monster. Today, millions of investors own exactly the same assets through indices like the S&P 500 or the MSCI World.

My great fear lies in what I call “investors without stomach.” Many who entered the market in the last two years through ETFs have never experienced a prolonged Bear Market. They are accustomed to double-digit annual returns with minimal volatility.

- Liquidity Risk: When these investors decide to sell, the ETF must sell the underlying shares indiscriminately.

- The Herd Effect: Since everyone holds the same index, everyone tries to exit through the same narrow door at the same time.

- Selling at the Worst Time: Human psychology is wired to avoid pain. Without a solid fundamental strategy, the passive ETF investor tends to capitulate at the bottom, turning temporary paper losses into permanent realized losses.

This massification increases systemic fragility. The market has become a giant with feet of clay, where price structure is dictated by flows rather than real value. When the flow reverses, the fall is accelerated by the very structure of the market.

5. Why I am Long VIX: My Defensive Thesis for 2026

It is within this context of euphoria, low liquidity, and structural risks that I am reinforcing my current position. As I explained in detail in my previous article, Why I am Long VIX in 2026, volatility is excessively cheap given the latent risks.

The VIX (Fear Gauge) acts like an insurance policy. In 2026, the cost of this insurance is negligible because no one believes a fire is possible. I prefer to pay a premium now and be protected against a “Left Tail” event (a rare and catastrophic event) than to be caught in the general stampede.

My strategy is not a bet against human progress, but a recognition that the economic cycle is not dead. We are in an interest rate regime that, while stable, does not allow for the infinite exuberance that current multiples suggest. Being Long VIX is my way of profiting from the inevitable panic that will arise when reality collides with the unrealistic expectations of AAII investors.

Authority Citations and Market Context

Analysts at Goldman Sachs and recent reports from the International Monetary Fund (IMF) have warned about the growth of private credit and market interconnectivity, which corroborates the snowball thesis. The Federal Reserve (Fed) itself, in its December 2025 minutes, mentioned the “necessary vigilance regarding the excessive valuation of certain financial assets.” When the authorities start using this tone, I choose to listen.

Frequently Asked Questions (FAQ)

1. What is contrarian sentiment, and why does it matter?

Contrarian sentiment is the strategy of acting opposite to the market majority. It is crucial because, at extremes of optimism (euphoria), the market has usually already priced in all the good news, leaving only room for disappointment and declines.

2. Why is low cash allocation a danger to the market?

Because cash acts as a buffer. If investors have no reserves, they cannot buy stocks during downturns. This removes price support and can lead to forced selling to cover margins or liquidity needs.

3. How can ETFs worsen a financial crisis?

ETFs automatically sell the assets that make up the index when investors redeem their shares. In moments of panic, this creates mechanical and indiscriminate selling pressure, accelerating the decline of all stocks regardless of their fundamentals.

4. Is the CNN Fear & Greed Index reliable for short-term predictions?

It is excellent for identifying emotional extremes, but it is not a precise timing tool. The market can remain in “Greed” for months. It should be used as a warning signal to reduce risk, not necessarily to sell everything immediately.

Conclusion: The Virtue of Prudence in a Sea of Optimism

In summary, the data I have presented—the galloping optimism of the AAII, the greed stamped on the CNN Business index, and the alarming lack of global liquidity—paints a picture of asymmetric risk. My opinion is clear: the current risk premium does not justify full exposure.

We are living in a moment where caution is seen as pessimism and prudence as cowardice. However, I prefer to be cautious now and have capital available when blood runs through the streets of Wall Street. The 2026 market is testing the patience of disciplined investors, but history shows that gravity always wins in the end. Keep your cash close, your hedges active, and above all, do not be swayed by the siren song of collective euphoria.

Disclaimer: This article represents my personal opinion and private trading positions for 2026. It does not constitute financial advice. Investing in the VIX and its derivatives involves high risk of capital loss. Always consult a certified financial advisor before making investment decisions.