In 2026, wealth preservation requires a strategic shift from fiat currencies to hard assets. The SPDR S&P 500 ETF Trust (SPY) has surged approximately 1,500% since 1993, while the US Dollar’s purchasing power has plummeted by over 50%. Utilizing Dollar Cost Averaging (DCA) into broad-market indices, Gold, and Bitcoin is the most effective strategy to hedge against systemic inflation and currency debasement, ensuring long-term capital appreciation through exposure to global value drivers.

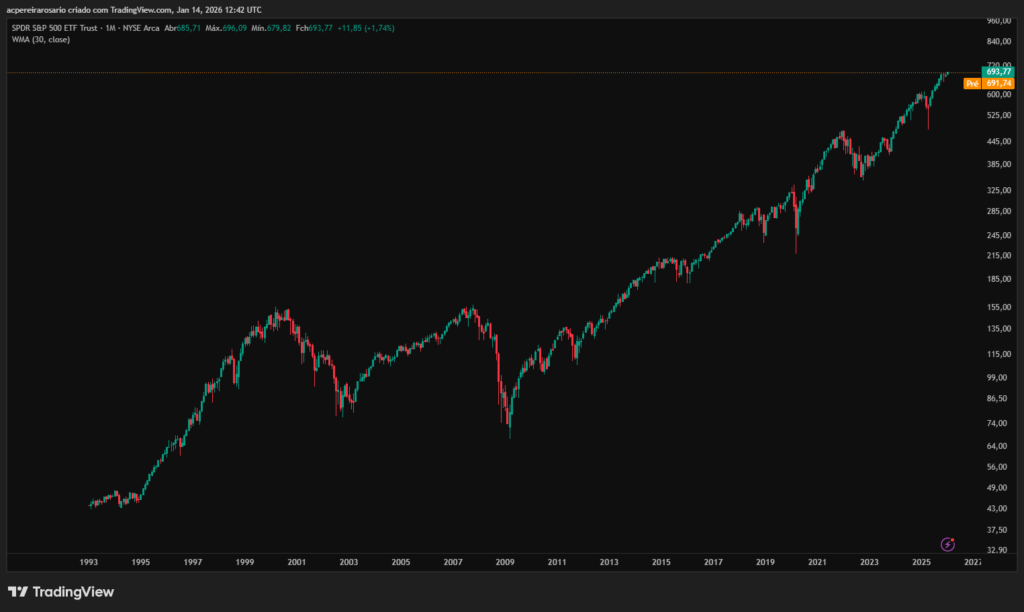

I am looking at the monthly chart of the SPDR S&P 500 ETF Trust (SPY) right now, and the conclusion is unavoidable: choosing not to invest is, quite literally, a decision to become poorer every single day. We are in January 2026, and if the last few decades—and specifically this monthly chart dating back to 1993—have taught us anything, it is that the traditional financial system was engineered to reward asset owners and penalize those who hold cash. Seeing SPY trade at $693.77 today, when it was navigating below $50 in 1993, is not just a market statistic; it is a profound testament to the silent destruction of fiat currency and the unstoppable ascent of productive capital.

1. The Fiat Trap and the Illusion of Traditional Savings

The greatest lie we were ever told was that “saving money” in a bank account is a prudent act. In the current 2026 landscape, with the Federal Reserve (Fed) and the ECB managing unprecedented levels of sovereign debt, inflation is no longer a “transitory” phenomenon—it has become a deliberate tool of monetary policy used to inflate away that very debt. Holding fiat currency—whether it’s Dollars, Euros, or Pounds—is the equivalent of holding a block of ice under the summer sun: it will melt; the only variable is the speed of the thaw.

When I discuss long-term investing, I am not talking about day trading or trying to “time the bottom.” I am referring to a deep, fundamental understanding that fiat money is merely a government promise, unbacked by any physical commodity, which can be printed into infinity. Conversely, investing in real assets and indices like the S&P 500 means buying a stake in human ingenuity and the profit-generating capacity of the world’s most dominant corporations. While inflation erodes your purchasing power, high-quality companies pass those costs to consumers and expand their margins, protecting the investor’s intrinsic value.

Since the abandonment of the Gold Standard in 1971, the purchasing power of global currencies has followed an exponential decay. What $100 bought in 1993 barely covers 40% of the same basket of goods today in 2026. Therefore, my stance is unwavering: holding significant excess cash is a fatal strategic error. Your capital must be allocated where there is either scarcity or value production.

2. Hard Assets: Gold, Silver, and the New Digital Frontier

Beyond equity indices, robust wealth protection must include assets that cannot be manufactured by central banks. Gold and Silver have served as the ultimate form of money for millennia. In 2026, as Gold hits new all-time highs above $4,300 per ounce, we are witnessing a massive flight to safety away from geopolitical instability and currency devaluation.

Silver, in particular, is an asset I believe is criminally undervalued by the masses, given its dual role as a precious metal and an indispensable industrial component in the green energy transition and the AI revolution (found in chips and solar panels). If you haven’t analyzed this sector yet, I highly recommend reading my detailed guide on Silver investing, where I break down why it could be the sleeper hit of the decade.

We also cannot ignore Bitcoin. By 2026, BTC has solidified its role as “Digital Gold.” Its mathematical scarcity—capped at 21 million units—is the perfect antidote to infinite monetary expansion. For the average investor, the smartest move isn’t trying to catch the next “pump,” but rather using the method that separates professionals from amateurs: Dollar Cost Averaging (DCA). I’ve explored this in-depth in my guide on how to DCA into Bitcoin, a strategy that removes emotional volatility and focuses on stacking sats over the long haul.

3. Understanding ETFs: Why SPY is the “King” of Indices

For those just starting, the term ETF (Exchange-Traded Fund) might sound intimidating, but it is actually the most democratic tool ever created for the retail investor. Imagine wanting to buy shares in Apple, Microsoft, Amazon, and hundreds of other leaders. Instead of buying them individually, you buy a single “share” of a fund that already owns them all for you.

SPY is the ETF that tracks the S&P 500, the index of the 500 largest publicly traded companies in the United States. By investing in SPY, you are putting your capital to work with the best managers and most innovative companies on the planet. If a company stops being competitive, it is dropped from the index, and a new winner takes its place. It is a “survival of the fittest” mechanism that, as the chart shows, tends to move up and to the right over decades.

Advantages of using ETFs like SPY:

- Instant Diversification: One trade gives you exposure to hundreds of businesses.

- Liquidity: You can buy or sell at any moment during market hours.

- Low Cost: Management fees (expense ratios) are minimal compared to traditional bank funds.

- Tax Efficiency: In many jurisdictions, ETFs are more efficient for long-term compounding.

To find the ETFs you are looking for, here is the link to this website: ETF portfolios made simple.

4. Practical Simulation: The Power of DCA from 1993 to 2026

Let’s analyze the historical data provided by the monthly SPY chart. In February 1993, the price hovered around $44. Today, in January 2026, we are at $693.

Imagine a “normal” investor who, instead of trying to time the market, decided to invest $100 every single month, religiously, regardless of whether the market was up or down.

| Investment Period | Total Invested (Fiat) | Estimated Final Value (SPY) | Purchasing Power (Cash Under Mattress) |

| 1993 – 2026 (33 years) | $39,600 | **~$385,000** | $39,600 (buys ~$15k worth of 1993 goods) |

| Annualized Return | – | ~10.7% (inc. dividends) | – |

Note: Data reflects the actual growth of SPY and average dividend reinvestment (DRIP). Source: 2026 Market Analysis and S&P Global reports.

What this table tells us is shocking. If you had kept that $100 a month under your mattress, you would still have $39,600 today, but that money would buy less than half of what it bought in ’93. By investing in SPY via DCA, you transformed a modest monthly saving into a small fortune that vastly outpaces inflation. Time and Consistency are your greatest allies.

SPY & Investment Growth Simulator

Projected Future Balance

Investment Breakdown

Annual Breakdown Data

| Year | Total Invested | Interest Earned | End Balance |

|---|

5. My Personal View: Why the “Crash” is Your Opportunity

Many investors are paralyzed by the fear of a market crash. I, however, view corrections as “store-wide sales.” On the monthly chart, you can clearly see the major dips: 2000 (dot-com bubble), 2008 (financial crisis), 2020 (pandemic), and the 2022 bear market. What happened after every single one of them? The market recovered and hit new all-time highs.

My personal advice is this: ignore the daily noise. In 2026, we are still hearing that “the end of the Dollar is near” or that “the market is a bubble.” The reality is that as long as companies continue to innovate and fiat currencies continue to be printed, the nominal value of real assets and quality equities will continue to climb. Your focus should be on increasing your monthly contribution and keeping your DCA plan active across SPY, Gold, and Bitcoin.

6. How to Start in 2026: A Simple Step-by-Step

For those still on the sidelines, the process has never been easier:

- Open a Brokerage Account: Choose platforms with zero commissions and direct access to US markets.

- Define a Monthly Amount: It doesn’t have to be a lot. $50 or $100 makes a massive difference over 20+ years.

- Automate Your Investing: Set up an automatic transfer to buy SPY or an equivalent ETF every month.

- Diversify into Hard Assets: Don’t put everything in stocks. Allocate a portion to Precious Metals and Crypto to protect against systemic shocks.

FAQ – Frequently Asked Questions

What happens if I start investing and the market crashes immediately?

By using a DCA strategy, an early market crash is actually your best friend. With the same monthly amount, you will buy more shares of the ETF at a lower price, reducing your cost basis and magnifying your gains when the market inevitably recovers.

Is it safe to invest in an ETF like SPY?

SPY is managed by State Street Global Advisors and is one of the most liquid and regulated financial instruments in the world. While the share price fluctuates, the risk of the ETF “going to zero” is virtually non-existent, as it represents the 500 largest companies in the US economy.

How much money do I need to start?

In 2026, most brokers allow for fractional shares, meaning you can start investing in ETFs with as little as $1. The key is consistency, not the starting amount.

What is the difference between buying physical Gold and Gold ETFs?

Physical gold offers direct ownership and protection against a total banking system failure, but it carries storage and security costs. Gold ETFs (like GLD) offer easy, liquid exposure to the price of gold. A balanced portfolio often includes a mix of both.

Conclusion

Analyzing the historical chart of the SPY is a humbling reminder that patience is the most profitable virtue in finance. In 2026, the barrier between the middle class and true financial independence isn’t your salary—it’s your financial literacy and the courage to abandon the illusory safety of fiat currency. By purchasing hard assets, practicing DCA into proven indices, and hedging with gold, silver, and Bitcoin, you are building a financial “Noah’s Ark.”

Do not wait for the “perfect moment.” The perfect moment was 33 years ago when SPY was $44. The second-best moment is today. The market doesn’t care about your feelings; it only rewards those with the discipline to stay in the game.

Disclaimer: This article reflects my personal opinion and technical market analysis as of 2026. It does not constitute direct financial advice. Investing in financial markets involves risks of capital loss. Always perform your own due diligence or consult a certified financial advisor before making investment decisions.