Today is January 13, 2026, and we are standing at one of those crossroads that defines not just the end of a fiscal quarter, but potentially the economic narrative of an entire decade. As the market waits with bated breath for the CPI predictions today, Bloomberg and Reuters terminals are buzzing with estimates attempting to forecast whether the Bureau of Labor Statistics (BLS) will confirm the cooling we all feel in our daily lives or if there will be some statistical “rebound” that rattles investors. However, looking at the data I have in front of me—ranging from Truflation’s real-time indicators to the structural collapse of marginal costs enabled by Artificial Intelligence—my conviction is unwavering: the consensus is looking through the rearview mirror. While many still fear residual inflation, I find myself compelled to warn of the opposite phenomenon. We are rapidly entering a deflationary period that will rewrite the rules of the game for investors, corporations, and governments alike.

1. Decoding the Numbers: Consensus vs. Market Reality

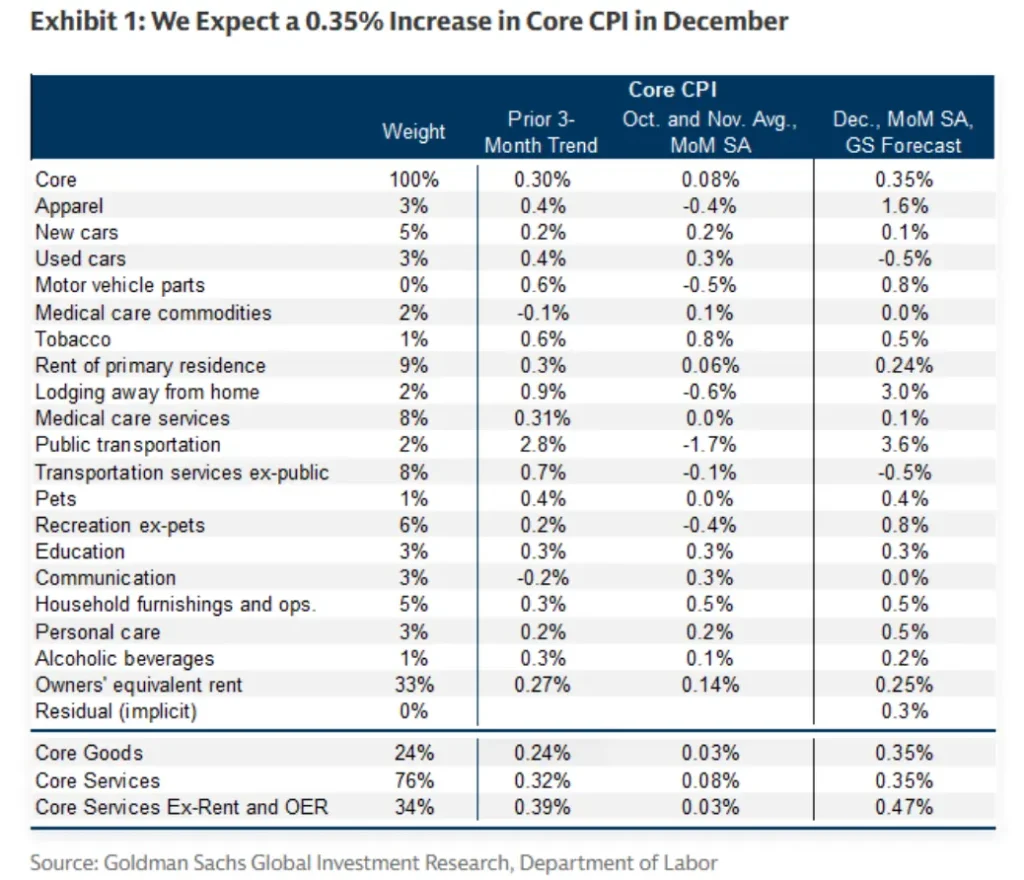

The CPI predictions today suggest a monthly change in the Core CPI (the inflation core that excludes food and energy) in the neighborhood of 0.35%, according to the latest projections from Goldman Sachs and other major Wall Street institutions. If we look closely at the weighting tables, we realize that the primary “villain” remains Owner’s Equivalent Rent (OER), which represents roughly 33% of the entire index. This is where the first major flaw in the official metric lies. The BLS uses data that carries a lag of 6 to 12 months compared to what is actually happening in the physical rental market. While the government is still processing contract renewals from mid-2025, the new contracts of 2026 already reflect a reality of stagnation and, in many tech hubs, an actual real-term decline in prices.

I monitor Truflation, which utilizes real-time data aggregators—processing millions of data points updated daily—and what I see is a yearly inflation rate currently sitting at 1.74%. This is significantly below the Federal Reserve’s 2% target. The official market still reports higher numbers due to statistical inertia, but “street inflation,” the kind we feel when purchasing technology or digital services, is already negative in real terms. This divergence between official data and real-time data is the window of opportunity for those who know how to read between the lines. The market is pricing in “sticky inflation,” but the underlying cost structure of the global economy is disintegrating. It is my firm belief that the “sticky” narrative is a myth created by outdated data collection methods that fail to capture the speed of modern commerce.

2. $60 Oil: The End of Energy Fear and the Data Center Paradox

One of the pillars that sustained inflation over the last five years was energy. However, observing the USOIL (WTI) chart I have been analyzing, the trend is unequivocally bearish. Even with the exponential growth in energy demand required to power the massive Artificial Intelligence data centers, the price of a barrel has struggled to stay above the $59.72 support level. We are in a scenario where energy efficiency and the influx of new production sources are more than compensating for the increase in computational consumption.

Key Takeaway: Oil at these levels acts as a massive subsidy for the global economy. Lower transportation costs translate to cheaper products on the shelves and higher margins for companies without the need to raise prices for the consumer. In fact, when energy—the input cost of almost everything in life—decreases or stabilizes, the inflationary engine loses its primary fuel.

Many analysts were wrong to predict that the energy crisis would last a decade. What they didn’t account for was technology’s ability to reduce energy intensity per unit of GDP. “Green AI” and grid optimization via advanced algorithms are allowing us to consume more bits with fewer barrels. I see the current price action in crude oil as a leading indicator of a global demand shift. We are moving from a world of scarcity to a world of optimized abundance. The fact that oil remains suppressed despite geopolitical tensions and massive data center growth tells me that the deflationary forces of supply and efficiency are winning the tug-of-war.

3. AI and Robotization: The Great Technological Deflation

This is the heart of my personal thesis. Artificial Intelligence is not just “another technology”; it is a deflationary general-purpose technology. If we look back at the Industrial Revolution, we saw machines replacing human muscle. Now, we are seeing algorithms replacing the human “neuron” in low and medium-value tasks. The marginal cost of producing a line of code, translating a document, designing an architectural project, or performing basic financial analysis has dropped essentially to zero.

Robotization, which is now seriously entering sectors like logistics and hospitality, completes this cycle. When the cost of labor—the largest cost component in most service companies—is replaced by technological capital that depreciates but doesn’t demand raises or suffer from consumer goods inflation, the inevitable result is price decline.

- Generative AI: Drastic reduction in marketing, design, and customer support costs.

- Industrial Automation: Factories operating 24/7 with minimal human intervention, lowering the cost of durable goods.

- Vertical Software: Administrative efficiency that eliminates bureaucratic redundancies.

I sincerely believe we are underestimating the speed at which these technologies will force prices downward. In a world where the supply of digital services is infinite and the cost of production is minimal, inflation becomes a mathematical impossibility in the long run. If you are not factoring in a 0% or negative cost of intelligence into your 2027-2030 projections, you are likely overestimating future price levels.

4. The Fed’s Trap: Are Central Banks Reacting Too Late?

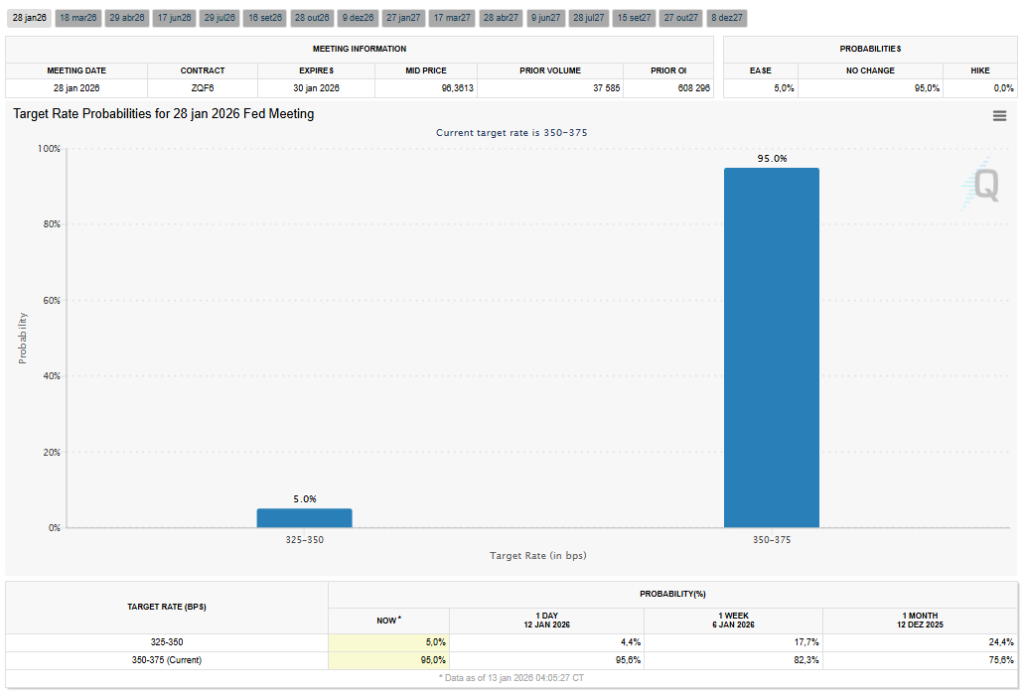

Analyzing the probabilities on the CME FedWatch Tool, I notice that the market assigns an 82.3% probability that the Fed will keep interest rates unchanged in the 3.50% – 3.75% range at the next January 2026 meeting. Only 17.7% believe in a 25-basis-point cut. This tells me that Jerome Powell and his team are still trapped by the fear of past inflation.

The risk here is monumental. By keeping rates high while real inflation (as seen in Truflation) is already below the target, the Fed is actually exercising an extremely restrictive monetary policy in real terms. This drains liquidity from the system and accelerates the transition to a demand-shock deflationary scenario. If the CPI predictions today come in below expectations, the market will begin to demand aggressive cuts. If they come in “on the line,” the Fed will continue to “sleep at the wheel” while structural deflation erodes economic foundations.

The “Higher for Longer” mantra might soon become the biggest policy error of the decade if they fail to recognize the deflationary wave of AI.

5. My Personal Vision: The Future is Deflationary

Now, I want to share my rawest position on the markets. Forget everything you’ve heard about “structural inflation due to de-globalization.” Yes, supply chains are more regional, but they are operated by robots and managed by AIs. The “cheap labor” factor of China is being replaced by the “free labor” factor of silicon.

I believe we are going to face a prolonged deflationary period. And why? Because technology is inherently deflationary. It allows us to do more with less. And when innovation reaches the scale it has in 2026, with language models that think in milliseconds and hardware that costs a fraction of what it did two years ago, prices have nowhere to go but down.

Take the example of televisions, smartphones, and now subscription services that use AI to generate content. The perceived value increases, but the delivery cost collapses. This phenomenon will spread to education, healthcare (through AI diagnostics), and energy. Oil at $60 is just the beginning; the real drop will come when fusion power or the next generation of solid-state batteries becomes commercial, making the cost of energy negligible. We are transitioning from an economy of scarcity, where prices rise, to an economy of abundance, where prices fall.

6. How to Invest in a World That Gets Cheaper?

Many investors were trained to invest in inflation-protection assets (like physical real estate or gold). But in a deflationary world, Cash and Long-duration Bonds become kings because their purchasing power increases without you having to do anything. However, the true winner will be productivity technology.

If a company can reduce its operating costs by 40% through AI and keep its prices stable (or lower them less than the competition), its margins explode. This is why, despite predicting deflation in consumer prices, I remain bullish on the companies that own the intelligence infrastructure. They are the new “landlords” of the digital economy.

For those who want to dive deeper into technical data and see how the US government calculates these indices, I always recommend a visit to the official Bureau of Labor Statistics website, where you can download detailed reports. Comparing official data with our technological deflation thesis is a fascinating exercise for any serious investor.

Conclusion

The CPI predictions today might bring short-term volatility. They might show a number slightly above or below expectations and cause a “rally” or a dip in the S&P 500 for a few hours. But don’t be fooled by the noise. The underlying trend is silent but unstoppable. The combination of brutally efficient technology, increasing robotization, and energy that cannot sustain high prices despite rising computational demand is the perfect recipe for deflation.

Prepare for a world where the challenge won’t be “how to pay the bills with rising prices,” but rather “how to maintain growth in a world where everything costs less and less.” The Fed might be distracted by the ghosts of 2022, but we must look toward 2027 and beyond. The era of inflation is over. Welcome to the era of deflationary abundance.

Feature article: The Civil War at the Federal Reserve