The financial world woke up in a state of absolute shock following the explosive press conference held by Jerome Powell on January 11, 2026. As someone who has scrutinized these markets for decades, I can tell you that we have rarely seen such a defiant and assertive tone from the leader of the most powerful central bank on the planet: the Federal Reserve. Powell did not merely discuss interest rates or inflationary targets; he openly denounced what he characterized as a “coordinated campaign of political intimidation and persecution” orchestrated by the Trump administration. The word echoing through the corridors of Wall Street right now is “survival.” The institutional independence of the Federal Reserve is under an unprecedented assault, with the Department of Justice (DOJ) serving subpoenas under the guise of investigating building renovation irregularities—a move Powell explicitly labeled a “pretext” to strip the central bank of its autonomy and force aggressive interest rate cuts.

1. The Trump-Powell Blood Feud: Subpoenas as Political Weapons

The tension between the White House and the Marriner S. Eccles Building reached a definitive breaking point yesterday. Donald Trump, staying true to his confrontational doctrine, has escalated his rhetoric, labeling Powell an “enemy of the American worker” for refusing to slash rates at the velocity the President demands to fuel his “Golden Age” economic narrative. The recent allegations focus on a $2.5 billion renovation project at the Federal Reserve headquarters, where the DOJ is allegedly investigating the “misuse of public funds.”

However, in his statement yesterday, Powell was crystal clear: monetary policy is determined by data, not by presidential decree. This “rock-solid” posture amidst a political hurricane is the only thing currently propping up the credibility of the U.S. Dollar, but my personal assessment is that the walls are closing in. When we see former Fed chairs and economic titans coming out of the woodwork to defend Powell, we realize this isn’t a mere policy disagreement—it is a struggle for institutional life. If the legal arm of the government is successfully used to remove a sitting Fed Chair before his term ends in May 2026, we risk transforming the United States into a “financial banana republic” where the printing press serves the incumbent’s re-election campaign rather than price stability.

2. The Successor Shortlist: Who Does Wall Street Actually Want?

With Powell’s mandate nearing its end, the “shortlist” of potential candidates is already causing either shivers or euphoria, depending on which side of the trade you are on. The markets are currently obsessing over a few key names that represent vastly different paths for the Federal Reserve:

- Kevin Hassett: Currently the Director of the National Economic Council, Hassett is widely viewed as Trump’s favorite. Ironically, he is the candidate markets consider the most “dovish” (pro-low rates). While his appointment might trigger a massive short-term rally in the S&P 500, it terrifies inflation hawks who fear a return to the runaway prices of the early 2020s.

- Kevin Warsh: A former Fed Governor with a more “orthodox” reputation. Warsh is highly respected by Wall Street for his “cool head” during the 2008 crisis. He represents a delicate balance: someone Trump respects but who possesses the technical gravitas to maintain global trust.

- Christopher Waller and Michelle Bowman: Both are current governors. Bowman, in particular, has distinguished herself as a “hawk,” warning against premature rate cuts. She is the preferred choice for those who believe the fight against inflation is far from over.

- Rick Rieder: The BlackRock titan would bring the “real-world” perspective of someone managing trillions. Institutional funds favor him for his sheer predictability and deep understanding of market liquidity.

In my personal opinion, the market’s “hidden” preference is Kevin Warsh. Why? Because capital hates uncertainty. While Hassett might promise the “cheap money” that fuels equity bubbles, he carries the systemic risk of destroying the Dollar’s credibility over the long term. Markets want a referee who knows when to say “no” to the President, and Warsh has the pedigree to stand his ground without being viewed as an outright antagonist.

3. What if the Federal Reserve Ends? An Exercise in Economic Chaos

The question posed in the title of this article is no longer confined to the fringes of internet forums; it is being discussed in the boardrooms of Goldman Sachs and BlackRock. Trump and his allies, including figures like Elon Musk, have flirted with the idea of “ending the Fed” or placing it under direct Executive control. But what would that actually look like?

If the Federal Reserve were abolished, the consequences would be immediate and likely catastrophic:

- Loss of the Lender of Last Resort: Without the Fed, who saves the banking system during a liquidity crunch? Bank runs would become a systemic feature rather than a rare bug.

- The End of the Dollar’s Reserve Status: Foreign central banks would dump U.S. Treasuries in a heartbeat if they believed the currency was being managed by a politician’s Twitter (or Truth Social) feed.

- Hyper-Politicization of Capital: Imagine interest rates rising or falling based on swing-state polling. It would be the death of long-term capital expenditure for corporations and a nightmare for mortgage-seeking families.

4. The Illusion of Control: Fed Funds vs. US02Y

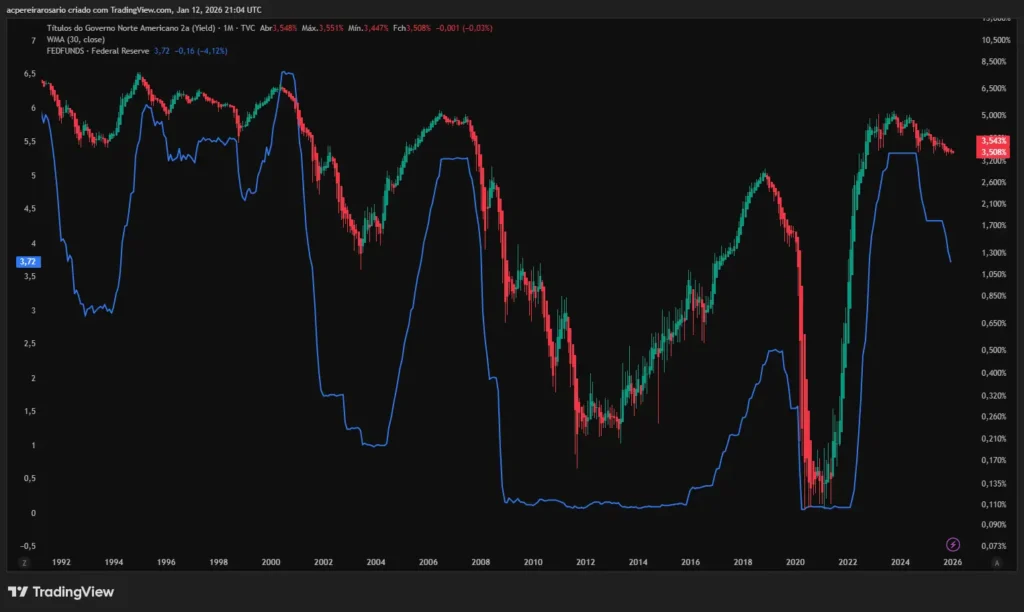

There is a fascinating technical argument that suggests the Federal Reserve is already obsolete because it merely “follows” the market. If you look closely at the chart of the Fed Funds Rate versus the US 2-Year Treasury Yield (US02Y), a striking pattern emerges. Historically, the bond market is the true leader; the US02Y yield almost always moves before the Fed makes its move.

When the 2-year yield drops, it is the market signaling that growth is slowing or that the current rate is “too tight.” Eventually, the Fed “catches up” and cuts. This leads us to an ironic conclusion: the Fed might just be a giant “lagging indicator.” However, my view is that the Fed provides the psychological floor. Even if the market dictates the direction, the Fed provides the “official” seal of approval that prevents volatility from turning into a blind panic. As seen in the provided image, the blue line (Fed) follows the white line (Market) like a shadow. Without the Fed, that shadow becomes a chaotic, jagged edge that could wipe out retail investors in a single afternoon of high-frequency trading.

“At this link, you can see the probability of the next rate cut by the Fed.

Conclusion: My Take on the Future of Our Money

We are witnessing a historical pivot. Powell’s conference on January 11, 2026, was a “crossing the Rubicon” moment for the American financial system. If he is forced out through a “weaponized” DOJ investigation, the institutional damage will be irreversible. My stance is clear: while the Federal Reserve has made many mistakes—most notably the “transitory inflation” debacle—having a flawed but independent referee is infinitely better than having no referee at all.

Investors should be preparing for extreme volatility. Assets like gold, silver, and perhaps even Bitcoin are looking increasingly attractive as the “political theater” threatens to burn down the theater itself. The Federal Reserve may not be perfect, but the vacuum its absence would create would be filled by a level of chaos that no trading algorithm is prepared to handle.