Why I Am Long VIX in 2026: Buying the Insurance Policy No One Wants

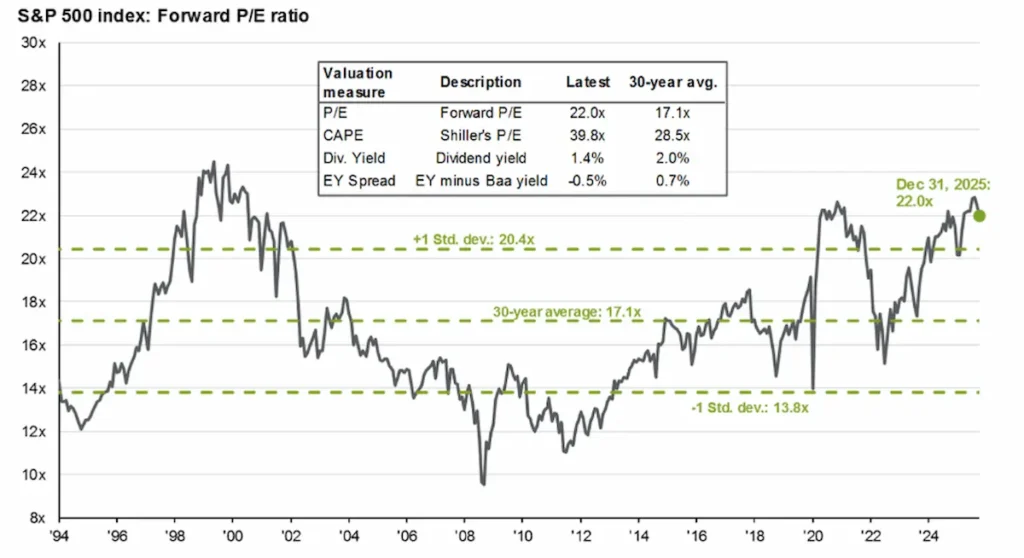

As of January 2026, the S&P 500 is trading at a dangerously stretched Forward P/E of 22.0x, far exceeding its 30-year historical average of 17.1x. Despite prevailing market euphoria, technical indicators and VIX term structure (Volatility) suggest an imminent mean reversion. I am strategically positioned Long VIX to capitalize on Q1 seasonality and looming macro […]