The 1875 Oracle: How the Benner Cycle Predicted 2026 and What to Do Now to Protect Your Wealth

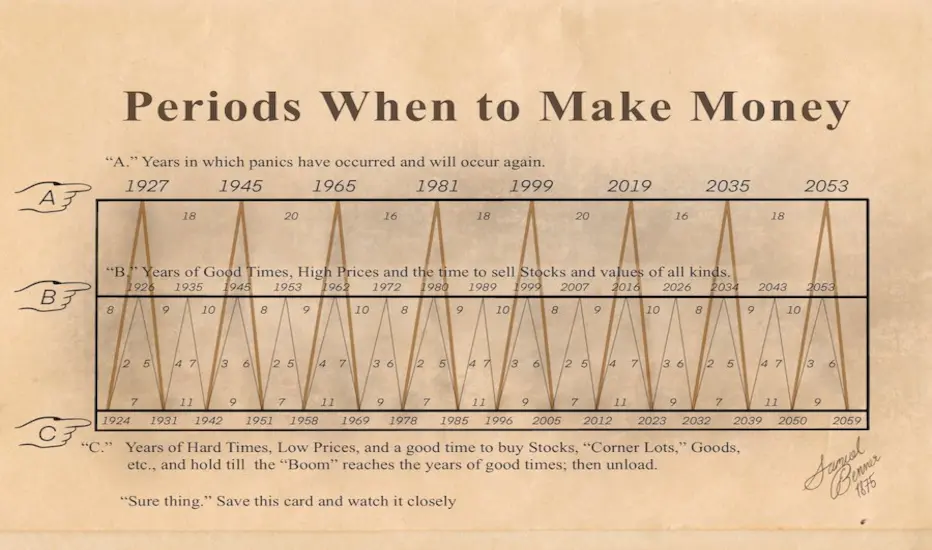

The Benner Cycle is a predictive model created in 1875 by Samuel Benner, based on price cycles of pig iron and agricultural products. The chart identifies three phases: Panic Years (A), Years of Good Times/High Prices (B), and Years of Hard Times/Low Prices (C). For 2026, the cycle signals a “Type B” period, indicating a […]